Winter 2026 Landowner Seminar Resources

Select the region where you attended to access presentations, speaker information, and additional landowner resources.

Future of Agriculture Scholarship Application

Sponsored by: Hertz Farm Management, Inc.

Application Deadline: April 15, 2026

Scholarship Overview

At Hertz Farm Management, Inc., we recognize that the future of agriculture depends on the next generation of driven, innovative, and passionate individuals. As part of our commitment to supporting the future of the agricultural industry, we are proud to offer the Hertz Farm Management, Inc. Future of Agriculture Scholarship, created specifically for Minnesota resident high school seniors pursuing careers in agriculture or related fields.

This scholarship is intended for students who demonstrate academic achievement, leadership potential, and a strong desire to make a lasting impact in the agricultural community. Whether your interest lies in crop science, ag technology, animal health, sustainable farming, agribusiness, or another ag-related field, we’re excited to support your educational journey.

Scholarship Amount: $1,000.00

Number of Awards: 3

Eligibility Requirements

- Be a Minnesota resident.

- Be a current high school senior graduating in 2026.

- Plan to enroll full-time in an accredited 2-year or 4-year college, university, or technical school.

- Intend to major in agriculture or an agriculture-related field (examples: agronomy, animal science, ag business, horticulture, environmental science, ag education, etc.).

- Have a minimum GPA of 2.5 on a 4.0 scale.

- Demonstrate leadership, community involvement, and a passion for agriculture.

Application Checklist

- Complete the online application.

- Upload your current high school transcript showing your cumulative GPA.

- Upload your essay answering one of the provided questions.

Bonita Springs, FL - Agenda with Map

Sarasota/Palmetto, FL - Agenda with Map

The Villages, FL - Agenda with Map

Chandler, AZ - Agenda with Map

Glendale, AZ - Agenda with Map

Palm Springs, CA - Agenda with Map

Presentations, Speakers, & Other Resources

Explore session topics, meet the speakers, and catch up on presentations from our recent event.

Connect me with a Farmland ProfessionalFeatured Speakers

Five experts offering practical insights for landowners and investors.

Presentations

Download slides from recent sessions.

Grain Markets

Dylan Daehn

View SlidesFarmland Leases

Troy Dukes

View SlidesTax / Transition Planning

Jeff Troendle

View SlidesClient Services at Hertz

Randy Hertz

View SlidesLand Trends & Values

Doug Hensley

View SlidesOther Resources

Additional resources for you as a landowner.

Client Information Packet

Curious what it’s like to be a Hertz client? This packet breaks down what you need to know.

Download Packet

Farmland Investment Fund

Grainfield Capital Management offers a way to include farmland in diversified portfolios.

Learn More

Subscribe to Our Emails

Be the first to know about seminars, listings, newsletters, and other ag industry news.

SubscribeLet’s Help You Achieve Your Farm Ownership Goals

Find out what Hertz can do for you and your farmland goals.

- Call us at 800-593-5263

- Or contact your nearest Hertz office

- Or fill out the form below to start a conversation

Protect Your Land. Plan for the Future.

Your Local Experts in Professional Farm Management, Farm Real Estate & Valuations

At Hertz Farm Management, we specialize in professional farm management, real estate sales, and farmland valuation. If you're wanting to maximize your farm's value and plan for your future, our experienced team is here to guide you.

Why Choose Hertz Farm Management?

- Recent farm sales expertise with proven results

- Decades of experience helping farmland owners

- Personalized strategies to help you succeed

Tell Us About Your Farm Goals

Give us a call at +1 (800) 593-5263

or Submit the form below to connect with one of our Farmland Professionals.

Maximize Your Farmland’s Potential

Expert Management. Reliable Returns.

Is Your Farm Underperforming?

Managing farmland is complex. Are you facing:

- Limited time for management?

- Unclear succession plans?

- Market or crop performance concerns?

We simplify ownership and maximize returns.

Why Choose Hertz Farm Management?

- Proven strategies to increase income

- Strong tenant relations for stable returns

- 99% client satisfaction – trusted by farm owners like you

“As we expand, our philosophy is to find property with high potential, improve it, and then once we’ve maximized it, continue to grow our asset.”

— Edward, farm owner and current client

How It Works

- Connect – Schedule a no-obligation meeting

- Customize – Define your goals with our experts

- Thrive – Watch your farm perform at its best

Your farm deserves expert attention. Let’s secure its future together.

Sustainable Farm Management for a Thriving Future

Protect your legacy. Enhance profitability. Preserve the land.

Is Your Farm Set Up for Long-Term Success?

Without expert management, farmland can face:

- Soil degradation and inefficient practices

- Tenant instability and declining land value

- Overwhelming legacy and succession planning

We help you balance sustainability with profitability.

Why Hertz Farm Management?

- Personalized strategies to improve soil health and yields

- Proactive stewardship aligned with your values

- Trusted by 99% of clients for exceptional service

“It’s our responsibility to make sure that we continue to make the farms better for the next generation.”

— Cheryl, farmland owner and current client

How It Works

- Connect – Schedule a no-obligation consultation

- Plan – Define your goals with our experts

- Grow – Implement sustainable, profitable solutions

Secure your farm’s future—start today.

Secure Your Farm's Legacy with Expert Management

Without a clear plan, your family's hard work may be lost to mismanagement, leaving future generations unprepared and disconnected from their heritage.

- Unsure how to pass on your legacy?

- Lost connection with your farmland?

- Unsure how to assess tenant performance?

Cultivate Your Legacy

- Expert guidance on succession planning and trusts

- Regular updates and farm tours to stay connected

- A team with 99% client recommendation rate

We Understand Your Concerns - You want assurance that your farm is in good hands.

- 99% Client Recommendation Rate - We prioritize your trust by maintaining high satisfaction levels.

- Experienced Professionals with Continued Education - Our team members are dedicated to always improving their expertise.

“Our farm manager understands that our goal is to be able to pass our farms on to the next generation and keep them in good shape.” - Nancy, farm owner and current client

Build a Legacy that Lasts for Generations

- Connect with Us – Share your farm goals and concerns with our experts

- Define Your Vision – Together, we create a personalized management plan

- Enjoy Peace of Mind – Trust our experienced team to handle the details.

Connect with a Hertz Farmland Professional Today

Get Your Free Guide: What to Expect as a Farm Management Client

Are you considering professional farm management but unsure what to expect? Our free guide walks you through the entire process, so you can make informed decisions with confidence.

In This Guide, You’ll Find:

✅ How professional farm management simplifies land ownership

✅ The key services and benefits we provide

✅ See a sample farm management report

✅ How we maximize your farm’s long-term success

With expert insights and a straightforward approach, this guide will help you understand how we work with landowners like you to protect, improve, and profit from your farmland—without the day-to-day headaches.

Fill out your information below and download your guide today!

Farm Management: Frequently Asked Questions

General Questions About Farm Management:

Our farm managers have extensive experience in agriculture, land management, and business operations. Many hold degrees in agricultural sciences, agronomy, or farm management, and maintain industry certifications. They stay up to date with the latest, best practices in farm leasing, conservation, and sustainable land use to provide the highest level of service.

No, our farm managers do not physically farm the land. Instead, they oversee the management and operation of the farm, ensuring that it is farmed effectively and in alignment with your goals. They work closely with farm operators and input suppliers, monitor crop progress, manage lease agreements, and provide expert recommendations on farm improvements. On participating leases where the landowner receives a portion of the crop, they also market the crop on your behalf.

Hiring a professional farm manager brings expertise, objectivity, and local knowledge to your team. Working with your tenant, a farm manager can help make your farm more profitable on a crop share lease or custom arrangement. On a cash rent lease, a farm manager can help bring information and experience to share with your tenant to help him/her be even more profitable, which in turn will allow him/her to pay market rents. The farm manager will help keep your cash rent at market levels, so that you receive the return you deserve. In most instances, your net income after paying a farm manager will be equal to or greater than what you experienced without a manager, plus you are relieved of having to spend your time and energy to manage the property. This frees you up to spend more time doing the things you enjoy, confident that your farm asset is being well cared for.

Questions About Working with a Farm Manager:

A farm manager can start anytime of the year, but one of the best times is during the growing season, as it gives the farm manager and the farm operator a chance to get to know each other before crop inputs need to be purchased in the Fall, or cash rent needs to be negotiated.

Our farm managers visit your farm multiple times throughout the year, with frequency depending on lease type, the farm’s needs and the season. Routine visits include pre-season planning, in-season crop inspections, harvest and post-harvest evaluations. We also conduct additional visits as needed to address any concerns or issues that arise or to be present to help coordinate the completion of major repairs or improvements as needed.

Yes! As the landowner, you maintain control over major decisions regarding your farm. Our role is to provide expert recommendations and manage the day-to-day aspects of farm operations on your behalf. We work closely with you to ensure your goals, whether financial, conservation-focused, or legacy-driven, are met.

We conduct regular field visits, monitor crop progress, and provide you with detailed reports and updates throughout the year. Our farm managers work closely with operators to ensure proper field maintenance, soil health, and overall farm productivity. Additionally, we use technology such as soil tests, aerial imagery and yield data analysis to track farm performance.

Questions About Tenants and Leasing:

Yes, we can work with your existing farm operator, provided they meet the standards and expectations necessary for the long-term success of your farm. Even if they don’t meet our standards, if you have other reasons that you wish to continue to work with your existing tenant, we will do so. We will make you aware of any concerns around their abilities or performance but will defer to you on the decision of whether to continue to work with your existing tenant, if that is your desire. Our goal is to maintain strong working relationships with operators while ensuring best farming practices are followed.

Certainly, we want to work as a team with you and your tenant, but you have to be the one who decides if you need a farm manager to join the team and represent your interests. While many tenants do a great job of looking out for your interests whenever they happen to align with their interests, it really isn’t reasonable to expect a tenant to represent your interests when they run counter to the tenant’s own interests. A farm manager can represent your interests while allowing your tenant to focus on his/her own. The farm manager can also share experiences and knowledge from other operations with your tenant. Working together can often make both the tenant’s operation and your operation even better. The best way to find out what a farm manager can bring to your team is to give us a trial run, which also allows your tenant to determine the value of working with us.

If you wish to change tenants, we can guide you through the process. We will evaluate prospective tenants, conduct interviews, and negotiate lease agreements to ensure you have a qualified operator who aligns with your objectives and the farm’s long-term sustainability.

Every farm is different and every farm owner has their own unique goals and objectives for their farm property. Our farm managers work with owners to help them determine which lease type provides the best opportunity for them to meet their goals and objectives. Having a no obligation meeting with one of our farm managers is a good step towards determining the right lease for you and your farm.

Questions About Financial & Transitional Considerations:

If your farm is operated under a participating lease, where you receive a portion of the crops grown, we will market your share of the crop on your behalf. Hertz has an in-house marketing committee made up of managers that have a passion for grain marketing. They use both fundamental and technical analysis to provide recommendations to all of our managers for trigger price levels or dates to market certain percentages of your crop. Grain marketing is one of the most emotional areas of farm management, making it difficult to do consistently well, but our marketing committee does a great job of providing recommendations that utilize a disciplined approach, taking a lot of the emotion out of the process and leading to outcomes that consistently beat the market average price.

Yes, we frequently work with multiple owners and often multiple generations on a farm, including siblings, children, grandchildren, cousins and other family members. We facilitate communication, help align ownership goals, and ensure all parties are informed about farm operations and financial performance. Our goal is to provide seamless management that respects the interests of all owners. We often provide continuity between generations that is difficult to duplicate any other way.

One of our objectives as a farm manager is to help you transition your farm assets to the next generation. We help provide continuity during the process and can often help you work through all the different options to arrive at a transition plan that best fits your family’s objectives. We are proud of the fact that we have helped a large number of families transition their farm assets through more than one and often more than two generations. A farm is a tremendous family legacy, and we enjoy helping families care for and transition this important family asset.

Still have questions? Let's Talk.

Every farm and landowner situation is unique. If you didn’t find the answer you’re looking for—or if you’re ready to explore how professional farm management can work for you—we’re here to help.

Call Hertz at 800-593-5263 or click the button below to find a Hertz representative near you.

Real Stories. Real Landowners. Real Results.

The land tells a story, but so do the people who care for it. Here, you'll find stories from landowners, farmers, and families who’ve trusted us to manage, buy, and appraise their farmland. Whether through heartfelt letters, or firsthand videos, these testimonials reflect the values we stand for—honesty, expertise, and a commitment to doing right by the land and those who own it.

We’re honored to walk alongside our clients, helping them make confident and informed decisions that preserve their legacy and grow their investment. Take a moment to hear their experiences—you might just find a story that resonates with yours.

Stewardship in Action: A New Landowner's Journey

"I could not do it without a farm manager... I'm very thankful that I've found Hertz." - Shannon Bishop

When Portland resident Shannon Bishop purchased a Minnesota farm, she partnered with Hertz Farm Management to bring her regenerative vision to life. Together with Farm Manager Steve Hiniker, she’s experimenting with crops like Winter Camelina and Kernza—building soil health, biodiversity, and a legacy of stewardship for the next generation.

Building a Legacy Through Partnership: A Farmland Investment Journey

When Brent Haverkamp first bought a small rental house in Ames, Iowa, back in 1991, he didn’t realize it would eventually lead to founding Haverkamp Group—a thriving real estate investment and development company. What started with multifamily properties expanded over time into a larger vision—one that included investing in one of the world’s most enduring assets: farmland.

"Farmland is how we hold wealth." - Brent Haverkamp

Read More →

A Farming Legacy Moves to the Midwest

Moving a household is always a daunting task, but relocating multiple households in a multi-generational family and a commercial row-crop farming operation nearly 900 miles away seems downright impossible. Yet, that’s exactly what father-son duo Joe and Austin Terhune set out to do.

“For us, this whole idea of relocating had to do with legacy and passing it on to not only my generation, the generation to follow me, but even future generations after." - Joe Terhune

Read More →

Growing Towards a Sustainable Future

"Keeping the soil healthy and the land in good shape is something that we can do now to set up our family for success in the future," explained Henry. "That's our mindset right now, make the most out of what we have and make it sustainable for the future."

From classrooms to farmland. Hertz clients Nancy and Henry Coan share their story of farmland ownership and building a farm legacy that will last for generations.

Read More →

Five Generations of Farmland Ownership

"We’re the fourth generation owning this land,” said Cheryl proudly. “Our kids will be the fifth - how incredible is that?"

Learn from Hertz clients Jennifer Dickey and Cheryl McKitrick as we explore their journey to creating a farmland legacy that's built to last.

Read More →

Investment in Wealth for Generations

Landowners Edward Otrusina and Julie Smith believe they’ve found the key to stewardship with one simple yet powerful approach: “Leave it better than you found it.”

What began with their father’s investment in Wisconsin in the 1970s has grown into a multi-state farmland portfolio built on responsible care, strategic improvements, and long-term planning.

Read More →

Selling a Farm Through Hybrid Auction

“If I had another farm, I would sell it through Hertz again.” - James Gould

James Gould Shares his experience with Hertz Real Estate Services to sell his farm through Hybrid Auction - a method that brough together in-person and online bidders for a competitive sale.

Read More →

Keeping the Farm in the Family

"It’s a special family connection,” explained Bob Winders. “It’s a part of our family history that dates back a long way, so one of our goals has always been to try and keep the farms in the family."

From Revolutionary War land grants to one of the largest livestock operations in the U.S., the family’s commitment to agriculture remains strong, with Hertz Farm Management helping guide the legacy forward.

Read More →How Can We Help You with Your Story?

Every farm has a history. Every landowner has a vision. Let’s write the next chapter together. Whether you need expert farm management, a trusted partner in buying or selling farmland, or a clear appraisal, our team is here to help.

Find your local Hertz representative today and let’s talk about how we can work alongside you to protect, grow, and honor your land’s legacy.

Contact a Hertz Farmland ProfessionalMake Confident and Informed Decisions About Your Farm

If you’re considering selling your farmland, the demand is still strong, but the approach to a successful sale in today’s market may be different than in previous years. Choosing the right sale method is critical to maximizing your outcome.

Learn About Our Proven Sale Methods

Each method comes with its own set of advantages, and we guide you through evaluating which is the best fit for your farm and your specific goals.

Download our free PDFs to discover which sale method may be best for your farm:

Brokerage Listing: A tailored approach for a more private transaction.

Public Auction: Open bidding with the potential for competitive offers.

One-Chance Sealed Bid: A confidential, no-pressure bidding process.

Ready to Talk About Your Farm?

Let's start with a no-cost, no-obligation conversation. Our experienced team will take the time to learn about your farm, analyze the local market, and provide you with a personalized strategy. Whether you're exploring options or are ready to make a move, we're here to help you make confident, informed decisions.

Submit the form below to be connected with one of our Farmland Professionals

Real Stories. Real Landowners. Real Results.

The land tells a story, but so do the people who care for it. Here, you'll find stories from landowners, farmers, and families who’ve trusted us to manage, buy, and appraise their farmland. Whether through heartfelt letters, or firsthand videos, these testimonials reflect the values we stand for—honesty, expertise, and a commitment to doing right by the land and those who own it.

We’re honored to walk alongside our clients, helping them make confident and informed decisions that preserve their legacy and grow their investment. Take a moment to hear their experiences—you might just find a story that resonates with yours.

Stewardship in Action: A New Landowner's Journey

"I could not do it without a farm manager... I'm very thankful that I've found Hertz." - Shannon Bishop

When Portland resident Shannon Bishop purchased a Minnesota farm, she partnered with Hertz Farm Management to bring her regenerative vision to life. Together with Farm Manager Steve Hiniker, she’s experimenting with crops like Winter Camelina and Kernza—building soil health, biodiversity, and a legacy of stewardship for the next generation.

Building a Legacy Through Partnership: A Farmland Investment Journey

When Brent Haverkamp first bought a small rental house in Ames, Iowa, back in 1991, he didn’t realize it would eventually lead to founding Haverkamp Group—a thriving real estate investment and development company. What started with multifamily properties expanded over time into a larger vision—one that included investing in one of the world’s most enduring assets: farmland.

"Farmland is how we hold wealth." - Brent Haverkamp

Read More →

A Farming Legacy Moves to the Midwest

Moving a household is always a daunting task, but relocating multiple households in a multi-generational family and a commercial row-crop farming operation nearly 900 miles away seems downright impossible. Yet, that’s exactly what father-son duo Joe and Austin Terhune set out to do.

“For us, this whole idea of relocating had to do with legacy and passing it on to not only my generation, the generation to follow me, but even future generations after." - Joe Terhune

Read More →

Growing Towards a Sustainable Future

"Keeping the soil healthy and the land in good shape is something that we can do now to set up our family for success in the future," explained Henry. "That's our mindset right now, make the most out of what we have and make it sustainable for the future."

From classrooms to farmland. Hertz clients Nancy and Henry Coan share their story of farmland ownership and building a farm legacy that will last for generations.

Read More →

Five Generations of Farmland Ownership

"We’re the fourth generation owning this land,” said Cheryl proudly. “Our kids will be the fifth - how incredible is that?"

Learn from Hertz clients Jennifer Dickey and Cheryl McKitrick as we explore their journey to creating a farmland legacy that's built to last.

Read More →

Investment in Wealth for Generations

Landowners Edward Otrusina and Julie Smith believe they’ve found the key to stewardship with one simple yet powerful approach: “Leave it better than you found it.”

What began with their father’s investment in Wisconsin in the 1970s has grown into a multi-state farmland portfolio built on responsible care, strategic improvements, and long-term planning.

Read More →

Selling a Farm Through Hybrid Auction

“If I had another farm, I would sell it through Hertz again.” - James Gould

James Gould Shares his experience with Hertz Real Estate Services to sell his farm through Hybrid Auction - a method that brough together in-person and online bidders for a competitive sale.

Read More →

Keeping the Farm in the Family

"It’s a special family connection,” explained Bob Winders. “It’s a part of our family history that dates back a long way, so one of our goals has always been to try and keep the farms in the family."

From Revolutionary War land grants to one of the largest livestock operations in the U.S., the family’s commitment to agriculture remains strong, with Hertz Farm Management helping guide the legacy forward.

Read More →How Can We Help You with Your Story?

Every farm has a history. Every landowner has a vision. Let’s write the next chapter together. Whether you need expert farm management, a trusted partner in buying or selling farmland, or a clear appraisal, our team is here to help.

Find your local Hertz representative today and let’s talk about how we can work alongside you to protect, grow, and honor your land’s legacy.

Contact a Hertz Farmland ProfessionalJoin Us at One of Our Summer 2025 In-Person Landowner Educational Seminars!

Learn how agriculture is evolving and how those changes will impact land values, leases and more. These seminars are designed for landowners who don’t farm their land. If you’re planning for the next generation of owners, we encourage you to bring your children and/or grandchildren!

To Register, select the location below that you would like to attend and complete the registration form.

Topics Include:

- Grain Markets

- Transitioning/Tax Planning

- Lease Trends/Leasing Alternatives

- Client Services

- Land Trends and Values

- Hertz Farmland Professionals Panel

Additional Information:

Registration begins at 8:30 a.m., Seminar from 9:00 a.m. to 3:00 p.m.

Registration confirmation, an agenda, and a location map will be provided to you.

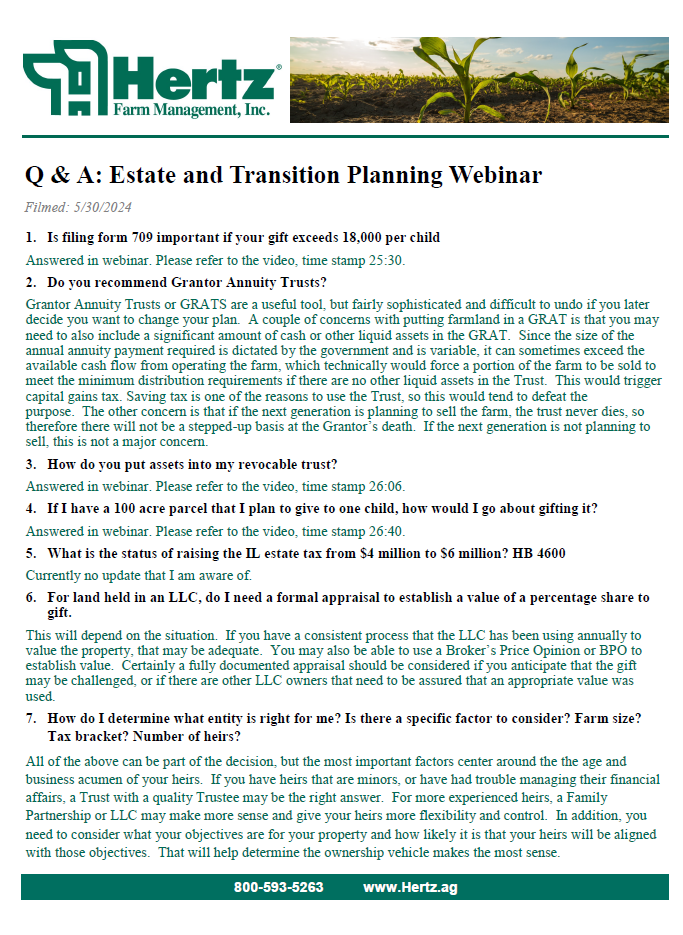

Webinar Materials: Estate and Transition Planning

Below are the slides and a recording of our Hertz Webinar on Estate and Transition Planning (filmed on 5/30/2024).

Click the document below to view the Q & A questions from the webinar.

Join Us for our FREE Estate & Transition Planning Webinar!

May 30, 2024

10:00 a.m. - 10:30 a.m. Central Time

Click Here to Register

Topics:

- The importance of planning for farmland ownership and transition

- Basic types of ownership entities, and whether they may make sense for you

- Current estate tax law & the scheduled sunset of the current tax law at the end of 2025

- The increasing urgency to start planning and connect with your transition plan advisor

- What Hertz brings to the table and how we can help you as a farmland owner

Your Local Experts in Professional Farm Management, Farm Real Estate & Valuations

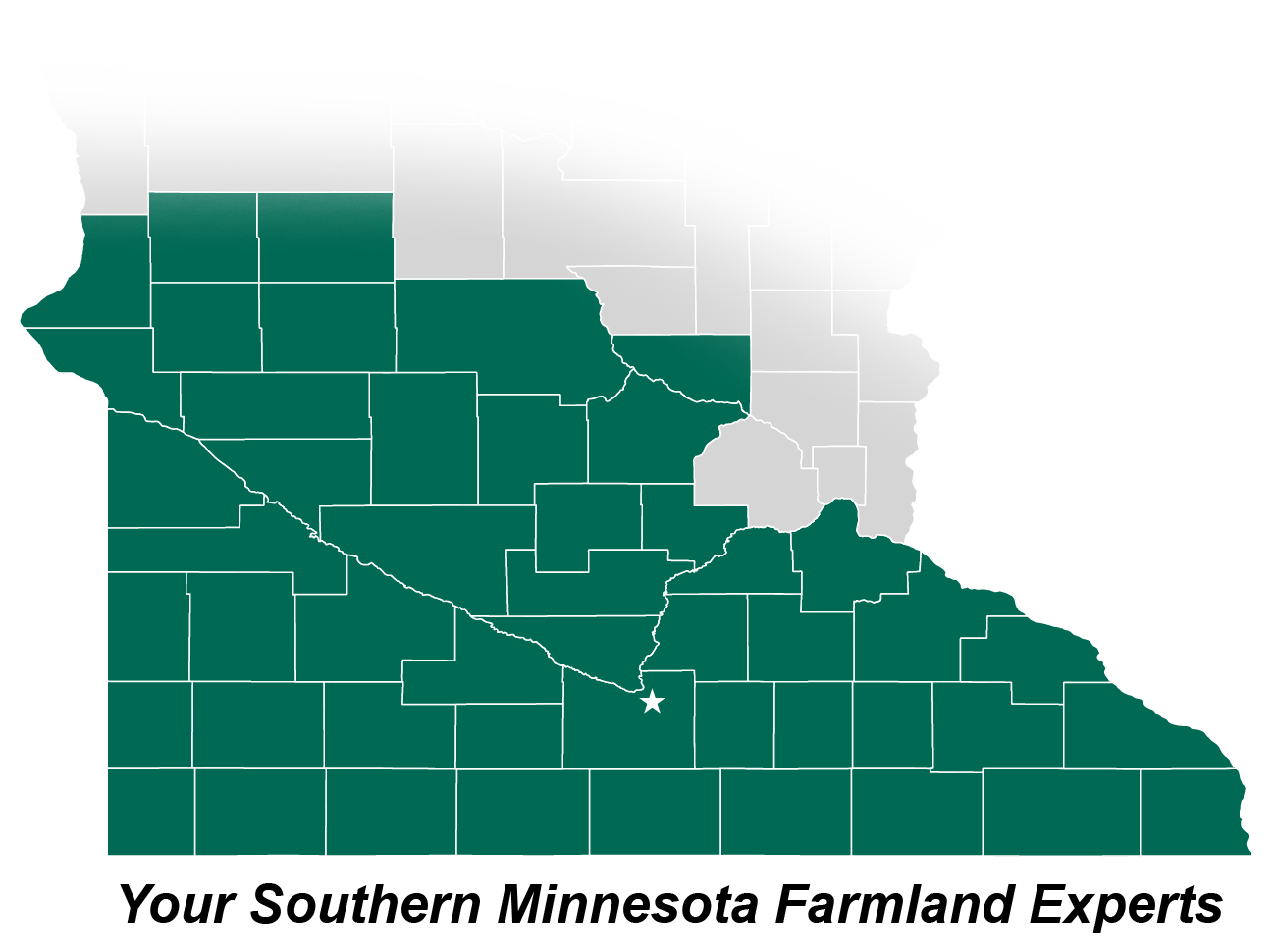

At Hertz Farm Management, we specialize in professional farm management, real estate sales, and farmland valuation. If you're wanting to maximize your farm's value and plan for your future, our experienced Mankato team is here to guide you.

Why Choose Hertz Farm Management?

- Recent farm sales expertise with proven results

- Decades of experience helping farmland owners

- Personalized strategies to help you succeed

Tell Us About Your Farm Goals

Give us a call at +1 (507) 345-5263

or Submit the form below to connect with one of our Farmland Professionals.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

Your Local Experts in Professional Farm Management, Farm Real Estate & Valuations

At Hertz Farm Management, we specialize in professional farm management, real estate sales, and farmland valuation. If you're wanting to maximize your farm's value and plan for your future, our experienced Norfolk team is here to guide you.

Why Choose Hertz Farm Management?

- Recent farm sales expertise with proven results

- Decades of experience helping farmland owners

- Personalized strategies to help you succeed

Tell Us About Your Farm Goals

Give us a call at +1 (402) 371-9336

or Submit the form below to connect with one of our Farmland Professionals.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

Your Local Experts in Professional Farm Management, Farm Real Estate & Valuations

At Hertz Farm Management, we specialize in professional farm management, real estate sales, and farmland valuation. If you're wanting to maximize your farm's value and plan for your future, our experienced Washington team is here to guide you.

Why Choose Hertz Farm Management?

- Recent farm sales expertise with proven results

- Decades of experience helping farmland owners

- Personalized strategies to help you succeed

Tell Us About Your Farm Goals

Give us a call at +1 (319) 382-3343

or Submit the form below to connect with one of our Farmland Professionals.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

There are lots of different farm lease options out there, but what's best for you and your farm? Download our comprehensive flyer to discover the different types of leasing solutions. For a more personalized approach, fill out the form below and discuss your current leasing situation with a Hertz Farmland Professional.

Let's Discuss Your Options

Fill out the form below and connect with a farmland professional.

Your Farmland, Our Expertise

Your farmland is not just land; it's a living legacy that connects your family's past to the future. While you may not be actively farming, we understand the immense emotional and financial value your farm holds for you. That's why at Hertz, we make it our mission to help you as farmland owners make confident and informed decisions about your farm.

In recognition of the increasing need for quality information, we'd like to invite you to subscribe to our Hertz newsletters, where you can read from experts in the field, and stay informed about the major topics surrounding agriculture.

Additionally, if you would like to speak to a farmland professional near your farm, please fill out the form below.

Subscribe Button

FORM

Hertz Landowner Seminar Presentations: Summer 2025

Click the buttons below to download presentations

Connect Me with a Farmland Professional

Our Farmland Professionals Can Help You Achieve Your Ownership Goals

Whether you are wanting to preserve your family legacy, maximize your farm’s potential, implement conservation practices, or all the above, our Farmland Professionals can help. In fact, 99% of our current clients would recommend us to other farmland owners.

Connect with a Hertz Farmland Professional Today!

Chuck Grassley Interview - August 2023

Our Services Videos

Our Services Videos

Take a look at our Hertz services videos and get a behind the scenes look at our Farm Management, Farmland Real Estate, and Agricultural Appraisal Services.

Real Estate Farmland Market Update

Real Estate Farmland Market Update

Doug Hensley, President of Hertz Real Estate Services, gives timely updates on farmland real estate and the driving factors influencing today's market.

Farmland Market Update Videos

Doug Hensley, President of Hertz Real Estate Services, discusses farmland values and the current factors impacting the land market.

Never Miss a Market Update

Want to stay on top of farmland values and industry trends? Subscribe to our monthly market insights—straight from our team of experts. If you have questions or need advice, we're just a click away.

Appraisal Services: Frequently Asked Questions

General Questions About Appraisals with Hertz:

An agricultural appraisal is an unbiased, professional opinion of the market value of a property used for agricultural purposes. This can include cropland, pasture, recreation, farmsteads, and more. The appraisal is typically used for decision-making related to estate planning, sales, legal matters, or finances.

Appraisals are commonly needed for estate planning or settlement, gifting, financial reporting, loan collateral, buying or selling land, litigation, or dividing property among family members or co-owners.

We appraise a wide range of rural property types, including row crop farms, pastureland, recreational land, farmsteads, and more complex operations like confined livestock facilities, grain storage sites, or irrigated farmland.

Value is determined by analyzing recent sales of comparable properties, reviewing income potential, and considering local land market trends. Our appraisers use industry-standard valuation methods including the sales comparison approach, income approach, and cost approach when appropriate.

Unlike residential appraisals, farm appraisals must account for unique factors like soil productivity, land use, and various types of improvements. Farm properties are also often valued using income-based models that reflect agricultural profitability.

Questions About Processes & Timelines:

Typical information includes property location, legal descriptions, current use, ownership history, existing leases, recent improvements, and any special considerations (e.g., conservation easements or zoning restrictions). Our team will guide you through what’s needed.

Most appraisals are completed within 2–4 weeks from the time of inspection, though this can vary based on property complexity, location, and availability of data. We’ll provide a realistic timeline at the start of the project.

Yes, and we often encourage it—especially if you can provide insights into the property’s history, improvements, or unique features. That said, your presence is not required, and the inspection can be done independently.

Questions About Working with Hertz for Appraisal Services:

Our appraisers combine boots-on-the-ground agricultural experience with deep market knowledge and professional credentials. We understand both the economic and emotional value of farmland, and we tailor our work to serve your unique goals with integrity and accuracy.

Yes. We frequently collaborate with legal and financial professionals on matters related to estate planning, trusts, ownership transitions, litigation, and tax reporting. We’re happy to be part of your advisory team.

Absolutely. Many clients request appraisals simply to understand their land’s current market value or to prepare for future decisions involving family planning, financial strategy, or long-term land use.

Yes. Our appraisers are certified and licensed, and many hold advanced designations through the American Society of Farm Managers and Rural Appraisers (ASFMRA).

Yes. We often provide appraisals to support equitable division of jointly owned land. This may involve valuing the entire parcel and its individual components to guide fair distribution or sale of shares.

Questions About Valuation of Complex Properties:

Yes. Our appraisers are experienced in valuing entire agricultural operations, including homes, outbuildings, storage facilities, and site improvements. We’ll provide both total value and breakdowns if needed.

If you're not ready for a full appraisal, we can sometimes provide a market analysis through our real estate team. However, a formal appraisal offers a more detailed and defensible valuation. We’ll help you determine which option best fits your needs.

Questions About Cost & Compliance:

Costs vary depending on the size, complexity, and location of the property. We’ll provide a quote after having a chance to review the project.

Yes. Our appraisals are performed in compliance with the Uniform Standards of Professional Appraisal Practice (USPAP) and are commonly accepted by courts, the IRS, lenders, and legal professionals.

Yes. Our experienced team has provided expert testimony in legal proceedings, including estate disputes, eminent domain cases, and other land valuation matters.

Still have questions? Let's Talk.

Every farm and landowner situation is unique. If you didn’t find the answer you’re looking for—or if you’re ready to explore how our trusted appraisal professionals can work for you—we’re here to help.

Call Hertz at 800-593-5263 or click the button below to contact us.

Real Estate: Frequently Asked Questions

Questions About Selling Farmland with Hertz:

It depends! There are many factors that can influence land sales and the overall market for farmland real estate. Some of these factors include:

- Commodity Markets

- Interest Rates

- Land Sale Volume – Locally and Market wide

- Location

- Type of Property

- Size of Property

At Hertz we stay on top of all these factors, which enable us to give you and your property the best localized and personalized recommendations. If you’re interested in exploring a sale, please call Hertz at 800-593-5263 or you can fill out our online form and we’ll have someone personally reach out to you.

The best sale method for your farm depends on your goals, timeline, market conditions, and personal preferences. Auctions—whether public, hybrid, or fully virtual—create a competitive bidding environment with a defined sale date and set terms. Brokerage listings offer more privacy, flexibility, and control over the buyer. Sealed bid sales provide a more discrete, controlled process while still encouraging competition and aggressive bidding.

Because every farm and farmland owner is unique, the right strategy varies. Factors like soil quality, location, buyer demand, and your specific objectives all play a role. That’s why the smartest step is to talk with a professional farmland real estate agent. An experienced agent who knows your local market and has the right tools—like targeted marketing and industry reach—can help you evaluate your options, and guide you to the method that will deliver the best results.

We offer several different service products relating to land valuation. The right one depends on your needs. As part of our research for preparing personalized sale recommendations, our team regularly conducts a detailed analysis based on soil quality, market demand, comparable sales, and local trends that will provide a clear range of value and pricing strategy.

As for standalone value reports, we also offer detailed Broker Price Opinions (BPO) for a fee, and the most robust valuation reports available, Certified Appraisals for a fee. Call or inquire for additional details.

We handle much of the preparation and collection of relevant data, including aerial photos, soil maps, tile maps, fertility information, and legal documents. However, it's often helpful to gather any past records, production history, surveys, or lease agreements you have.

We provide transparent, competitive fees that vary based on the sale method and services provided. You'll receive a full estimate up front in your personalized written recommendations—no surprises.

Absolutely! We regularly work with estate representatives, trustees, and attorneys to ensure the process is fair, well-documented, and handled with care.

Questions About Buying Farmland with Hertz:

It depends! Similar to selling a farm, the same factors that influence selling land, can have a reverse influence on the land buying environment. Having said that, buyers should evaluate each purchase opportunity based on their specific goals, the merits of the farm, and the larger market factors, including:

- Commodity Markets

- Interest Rates

- Land Sale Volume – Locally and Market wide

- Location

- Type of Property

- Size of Property

At Hertz we stay on top of all these factors, which enable us to give you the best localized and personalized advice on land investing.

For buyers looking to acquire a specific amount of land, either related to a 1031 tax-deferred exchange or simply in the strategic deployment of capital, we do offer comprehensive acquisition services.

If you’re interested in buying farmland or our acquisition services, please call Hertz at 800-593-5263 or you can fill out our online form and we’ll have someone personally reach out to you.

There are a couple ways you can find land for sale in your target area. First, you can connect with a farmland real estate agent. Second, you can join our weekly real estate email.

Get in touch with an agriculture real estate agent. If you’re a buyer, having a farmland real estate agent that watches the market regularly is an especially effective way to make sure you are always aware of farms for sale in your target area. Agents often get a ‘behind the scenes’ look and are able to learn about properties before they hit the market. This can give you a competitive advantage in some instances, and having a Hertz real estate agent on your side is definitely worth it!

Join our weekly real estate email! Every week we send out an email with all of our upcoming auctions, one-chance sealed bid sales, and new listings. Click here to subscribe.

Questions About Auctions and Specialty Services:

A hybrid auction allows buyers to participate either in person or online, giving your property maximum exposure and flexibility. It's a popular choice for sellers who want strong competition and wide reach.

A fully virtual online auction is another public auction sale method, only instead of a physical gathering at a banquet hall or hotel ballroom, the sale occurs 100% through our virtual auction platform. A live auctioneer still leads the sale, and bidders participate through our website or our smartphone app.

There are some distinct potential advantages that a fully virtual online auction can offer. For more information, talk to one of our farmland professionals.A One Chance Sealed Bid Sale (OCSBS) is a method of sale that Hertz has perfected and widely employed for many years.Essentially, we market a property with equal intensity to a public auction, and instead of the sale culminating in an auction event, an OCSBS concludes with a well-publicized bid deadline. Interested buyers will request a bid packet during the marketing period, and are required to submit their one highest and best bid by the noted deadline.

Among other common advantages, this method encourages aggressive bidding, while also allowing you, as a Seller, to make your decision in a more private and discrete manner.

Yes! We regularly assist with 1031 tax-deferred exchanges and can guide you through the timeline, rules, and reinvestment strategies to ensure compliance and long-term value.

General Questions About Hertz Real Estate Services:

We specialize in farmland. Our agents have deep agricultural knowledge, stay current on market trends, and use tools and strategies tailored to farmland and farmland owners. This isn’t just what we do—it’s who we are.

We have a strong presence across the entire Midwest, with offices scattered throughout Iowa, Illinois, Minnesota, and Nebraska. We have clients from all around the globe who own land in every corner of the Midwest. Our agents are local experts who understand the asset class, land values, the factors that influence land values, and buyer behavior.

Our sales fees are generally percent commission-based, and we custom-tailor our sales services to best meet your needs and the work that we will complete on your behalf.

Our acquisition work is often priced based on a flat-fee per acquired acre.

We believe each fee approach best aligns our rewards to match with our clients. There’s no one size fits all approach with our professional fees, as everything is customized to you and your property. For the vast majority of our projects, we will first talk with you about your needs, and your property, before completing a written proposal that will describe your options and any associated professional service fees. Typically, the initial consultation and proposal comes at no cost and with no obligation.

Still have questions? Let's Talk.

Every farm and landowner situation is unique. If you didn’t find the answer you’re looking for—or if you’re ready to explore how our trusted farmland professionals can work for you—we’re here to help.

Call Hertz at 800-593-5263 or click the button below to find a Hertz representative near you.

Farm Succession Planning

At Hertz, we understand the importance of having a well-thought-out farm succession plan. As the agriculture landscape evolves and family farms transition from one generation to the next, proper planning becomes an essential element for ensuring the long-term sustainability and success of your farming operation.

What is a Farm Succession Plan?

A farm succession plan serves as a roadmap for the seamless transfer of assets, responsibilities, and decision-making authority from one generation to the next. It is a strategic approach that allows you to safeguard the legacy you have built while providing for the future of your family and farm.

Why Should You Have a Farm Succession Plan?

One of the key reasons why a farm succession plan is crucial is that it minimizes the potential for conflicts and uncertainties. By proactively addressing these issues through a succession plan, you can maintain family harmony and preserve the unity that has been the foundation of your farming legacy.

Additionally, a well-executed farm succession plan enables you to efficiently manage financial aspects such as estate taxes, capital gains, and other potential liabilities.

Furthermore, a succession plan provides a framework for identifying and preparing the next generation of leaders within your family.

A farm succession plan is not merely an administrative task; it is an investment in the future of your family, your farm, and the agriculture industry as a whole. By proactively addressing the complexities of succession, you secure your legacy, mitigate potential conflicts, optimize your financial resources, and nurture the next generation of farming leaders.

How Do I Get Started on a Farm Succession Plan?

The first step is to get in-touch with an attorney with experience in creating succession plans specifically for farmland owners. If you don’t know an attorney that specializes in succession planning, we would be happy to help you find someone who fits your goals. Additionally, we can help guide you through the process, offering expertise and insights to help you create a robust succession plan that safeguards your farm’s sustainability and paves the way for a prosperous future.

If you would like to talk to a Hertz Farmland Professional about your specific situation, please call us toll free at 800-593-5263 or you can fill out our online form and we will have someone reach out to you.

I Just Inherited a Farm... Now What?

Inheriting a farm can be both an exciting and a challenging endeavor, especially if you’re new to the agriculture industry. We understand, it can be a little overwhelming inheriting a big asset like this, but don’t panic! That’s where we come in.

At Hertz, we specialize in providing farmland services tailored to meet your specific needs. Whether you want to know the value of your farm, sell your farm, or keep the farm for future generations, we’re equipped to help you navigate these big decisions.

We are passionate about helping you unlock the full potential of your inherited farm. With our expertise and personalized approach, we strive to alleviate stress and give you piece of mind, enabling you to enjoy the rewards of your investment.

Take the first step towards success and make the most out of your newly inherited farmland asset. Call us toll free at 800-593-5263 or fill out our online form and we will have a Hertz Farmland Professional reach out to you.

Explore Conservation Practices to Protect and Improve Your Land

There’s no one-size-fits-all approach to conservation. At Hertz, we work with landowners to implement farmland conservation practices that make sense for their unique goals. Whether you're looking to improve soil health, enhance water management, or explore long-term preservation strategies, we're here to help you make the most of your land.

Explore a variety of topics below designed to support sustainable farmland stewardship. Simply click the image below to start your journey.

Why Conservation Matters

Conservation isn't just about today — it's about the long-term health of your farm and community. Implementing smart stewardship practices:

- Improves soil fertility and structure

- Enhances long-term yields

- Protects water quality

- Supports biodiversity

- Preserves your legacy for future generations

Get Local Conservation Support

The Hertz Stewardship Committee is a team of dedicated farmland professionals who meet regularly to discuss conservation strategies and emerging stewardship practices. Their insights help guide our company’s conservation efforts and ensure we’re offering clients the most up-to-date, effective tools for long-term land health. Whether it’s evaluating a new cost-share program or weighing the benefits of a practice in a specific region, this committee helps landowners make confident, informed decisions.

Our Stewardship Committee includes regional experts who understand the conservation opportunities in your area. Whether you need help navigating cost-share programs or want to explore new practices, we're here to help.

Don't see your area listed? Contact us and we’ll connect you with the right farmland professional.

At Hertz, we’re here to help you implement conservation practices that work for your land. Whether you want to improve soil health, reduce erosion, or enhance water quality, our team can guide you through the best options for your farm. Call us at 800-593-5263.

Attorneys licensed in Iowa, Illinois, and Nebraska will receive up to 4 hours of CLE for attending one of our Landowner Educational Seminars.

Iowa Attorneys - Receive 4 hours for all Iowa Seminars, the Omaha Seminar, the Rock Island Seminar, and the Rochester Seminar.

- Cedar Rapids, IA - July 25, 2025

- Sioux City, IA - July 29, 2025

- Dwight, IL - July 30, 2025

- Omaha, NE - July 31, 2025

- Ames, IA - August 1, 2025

- Fairfield, IA - August 5, 2025

- Rochester, MN - August 6, 2025

- West Des Moines, IA - August 7, 2025

- Rock Island, IL - August 12, 2025

- Cedar Falls, IA - August 14, 2025

Illinois Attorneys - Receive 4 hours for all Illinois Seminars.

Nebraska Attorneys - Receive 3.91 hours for the Nebraska Seminar.

Minnesota Attorneys - Receive 3.91 hours for all Minnesota Seminars.

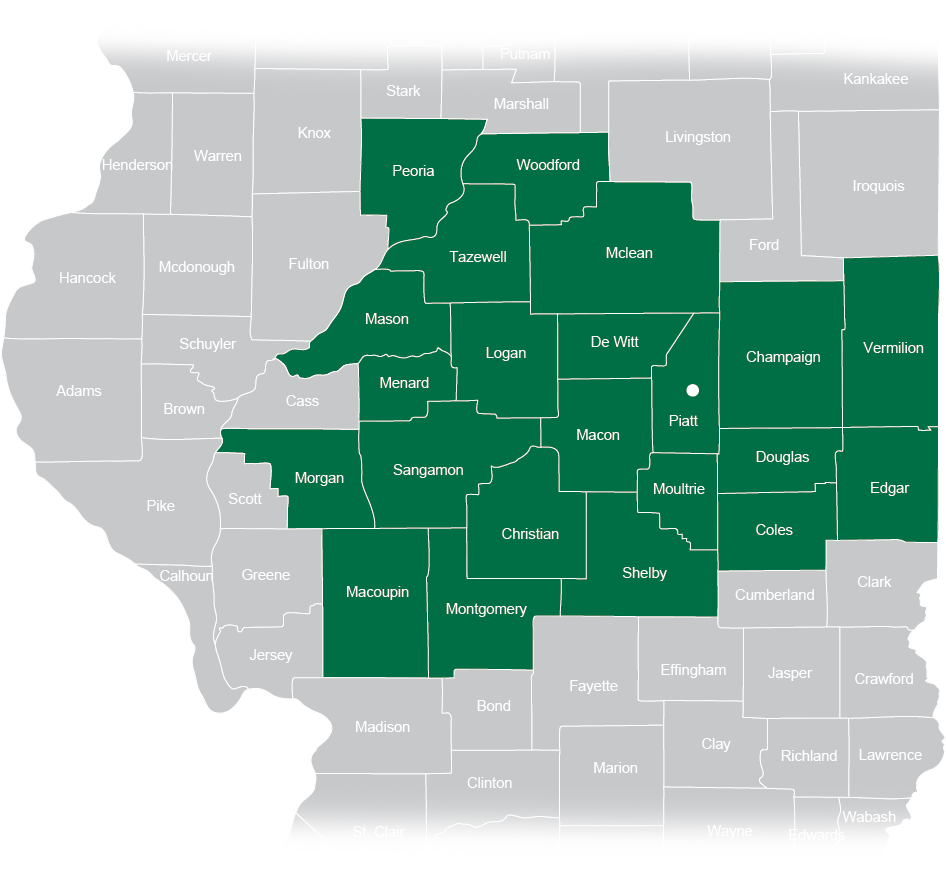

Sell Your Farm with Confidence.

Our Central Illinois team is ready to assist with your land sale. We sell farm properties by private listing, public auction, and sealed bid sale methods. We also work with investors looking to acquire land.

- Professional Auctions

- Tax-Deferred Exchange

- Buyer Representation

- Maximum Returns

Demand For Illinois Farmland Is High!

Our Monticello, IL, Farmland Professionals are ready to help you sell your farm with confidence.

Mankato, MN - Agenda and Map

Cedar Rapids, IA - Agenda and Map

Sioux City, IA - Agenda and Map

Dwight, IL - Agenda and Map

Omaha, NE - Agenda and Map

Ames, IA - Agenda and Map

Fairfield, IA - Agenda and Map

Rochester, MN - Agenda and Map

West Des Moines, IA - Agenda and Map

Rock Island, IL - Agenda and Map

Cedar Falls, IA - Agenda and Map

Hertz Landowner Educational Seminar - August 4, 2022

Below is the information from our Hertz seminar on August 4, 2022. If you have questions, concerns, or would like to be personally contacted, please reach out to Kayse Jenkins (kaysej@hertz.ag).

Scroll down to view all presentations and slides.

Grain Markets

Click here to download the slides from the Grain Marketing Presentation.

Supply Chain Issues Impacting Agriculture

Click here to download the slides from the Supply Chain Impacts on Agriculture Presentation.

Farmland Leases

Click here to download the slides from the Farmland Leases Presentation.

Land Trends & Values

Click here to download the slides from the Land Trends and Values Presentation.

Building Wealth Across Generations

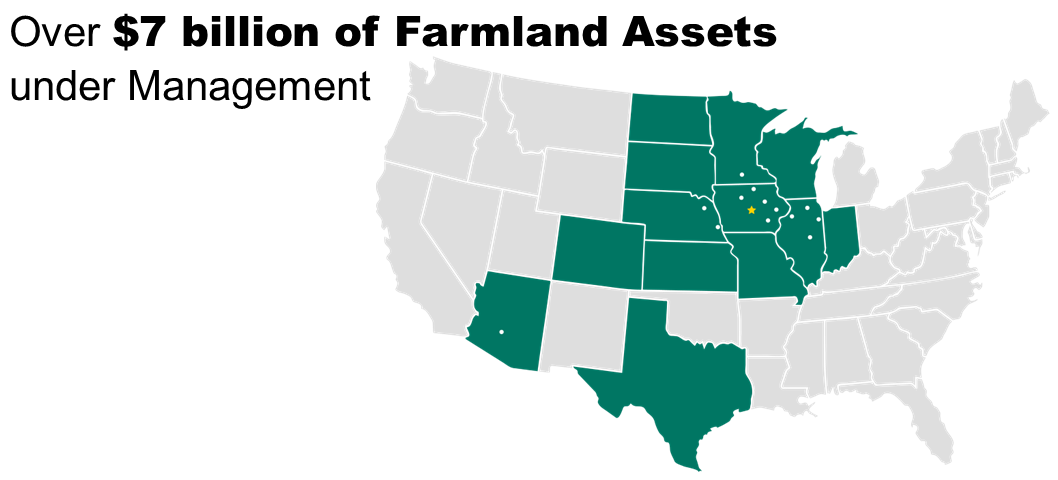

For over 75 years, Hertz Farm Management has been a premier farmland asset management company in the Midwest serving as a trusted partner to generations of farmland owners. We specialize in professional farm management, land acquisitions, farm appraisals as well as farm real estate sales, auctions and acquisitions.

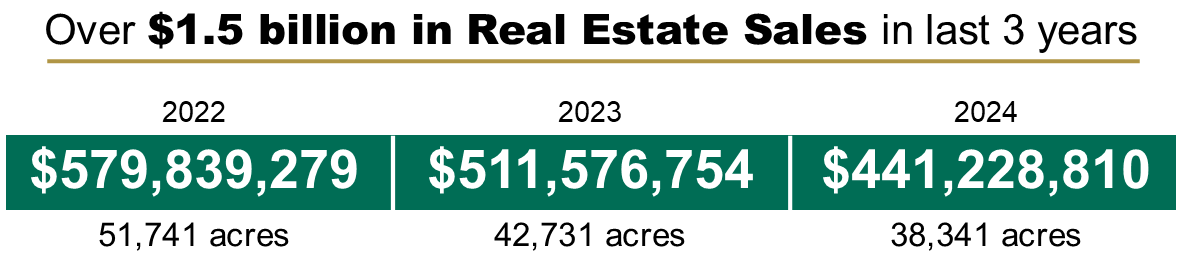

With offices throughout the Midwest, Hertz manages over 3,000 farms consisting of more than 674,000 acres with a value of over $7 billion. Our real estate team brokered over $1.5 billion in farmland transactions over the last 3 years.

75 years of Professional Farm Management Experience

- Strong presence across key region of the Midwest allow opportunity to diversify by geography

- Extensive network of clients and operators provides proprietary access to off-market opportunities

- Professional managers identify top growers to enhance performance and achieve competitive rents

- Focus on environmental best practices and sustainable management

- Multiple operating/leasing strategies provide opportunity to maximize risk-adjusted income potential

Farmland Investment Opportunity

- Farmland is a proven investment

- Strong fundamentals for investment continue for real assets with strong demand and limited availability

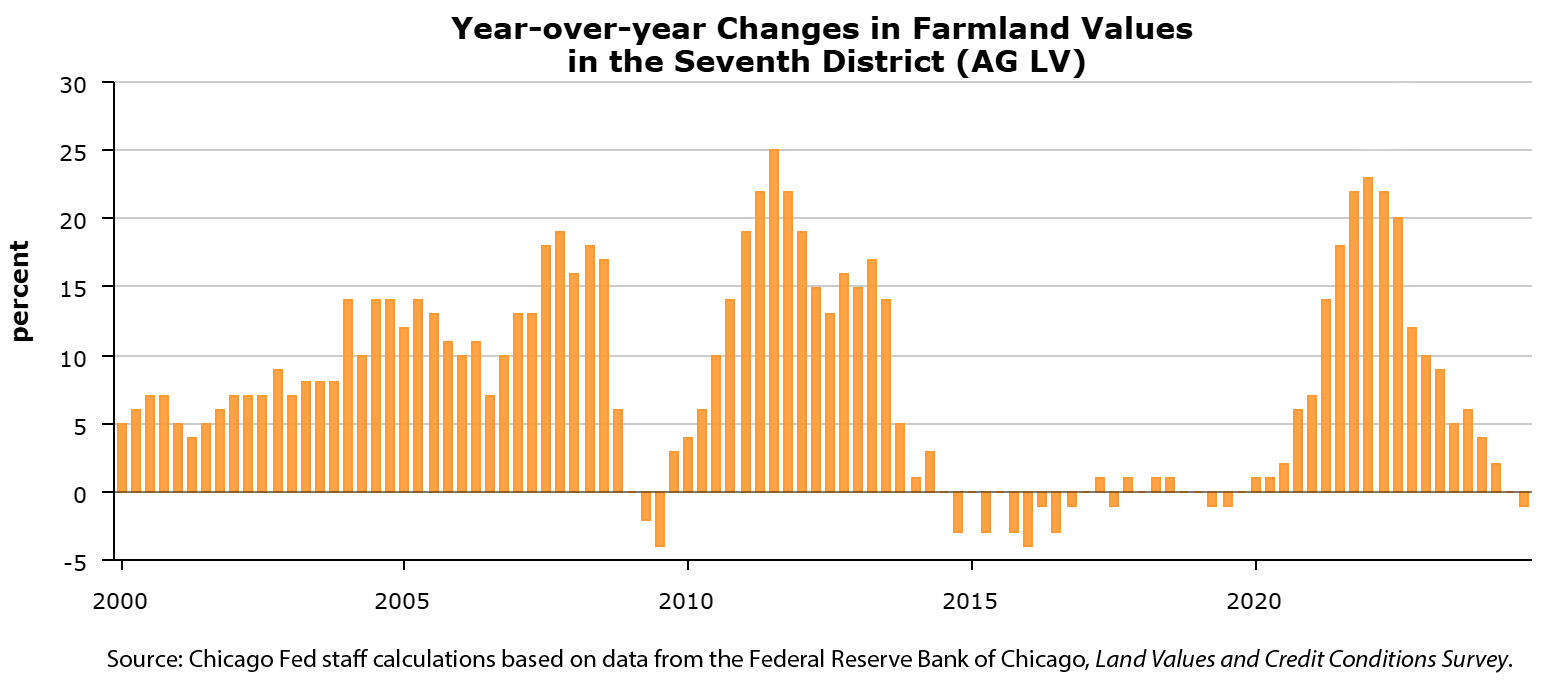

- Growing global demand of agriculture food products

- While farmland values follow commodity price trends, they have shown resilience in recent years (see illustration below)

- Farmland prices did not weaken to the extent corn and soybeans prices did

- Relatively low investor penetration; high barriers to entry

- Attractive risk-adjusted return profile

- Technology advancements provide opportunity to improve yields and operator economics

- Annual income return combined with long term capital growth

- Provide exposure to commodity markets without the short-term volatility

- Cash lease agreements transfers short term weather and crop production risk from the land owner to the operator

Farmland Investment Fund

Grainfield Capital Management offers high net worth investors, family offices, and advisors serving affluent individuals the opportunity to include farmland in investment portfolios. Click below to learn more.

How can we help?

Educational Resources

Learn about our services in these videos

Click Here to view our full Video Library

Keep up to date on important issues for landowners with our newsletters

Click Here to join our mailing list

Follow us on Social Media

Check our Blog for farmland market news and company updates

“One of the things that’s exciting about celebrating 75 years is looking ahead to the next 75 years and being focused on the foundation that Carl built, of standing out to do what’s right and take care of people.” - Chad Hertz, 3rd generation owner

On March 1, 1946, Carl Hertz opened Hertz Farm Management in Nevada, IA. His goal, to provide the highest level of service, advice, communication and commitment with integrity and care.

Today, 75 years later, that is still our promise and what drives Hertz Farm Management. Over the years we have had the opportunity to work with countless families, helping them make decisions that were right for them and their families. Whether it was how to keep the farm in the family, understand the value of what they have inherited or to sell their farm to settle the family estate, Hertz was there to help build their family legacy.

“The most important value is taking care of people, listening and really being client focused.” - Randy Hertz, 2nd generation owner

Sorted by Date: From New to Old

November 202 Wallace's Farmer "MarketPlace Extra"

New Podcast Episode - Crop and Health Status Update

New Podcast Episode - 2022 Season Insect Outlook

New Podcast Edpisode - Delayed Planting Considerations

New Pdcast Episode - Planting/Spring Weather Outlook

Winter 2022 Hertz Outlook Newsletter

New Podcast Episode - 3/7/2022

Ag Update Newsletter - Winter 2021

New Podcast Episode - 12/2/2021

November 2021 Wallace's Farmer "MarketPlace Extra"

New Podcast Episode - 10/14/2021

October 2021 Wallace's Farmer "MarketPlace Extra"

September 2021 Wallace's Farmer "MarketPlace Extra"

August 2021 Wallace's Farmer "MarketPlace Extra"

July 2021 Wallace's Farmer "Markeplace Extra"

June 2021 Wallace's Farmer "MarketPlace Extra"

May 2021 Wallace's Farmer "MarketPlace Extra"

April 2021 Wallce's Farmer "MarketPlace Extra"

March 2021 Wallace's Farmer "MarketPlace Extra"

SOLD! Jefferson Co., IA Land Auction

February 2021 Wallace’s Farmer “MarketPlace Extra”

Iowa Farmland Steady to Slightly Higher

Farmland Shows Strength Going Into 2021...

Thanks for your feedback!

Find a Farmland Professional

Commodity Markets: Symbol Search

Copyright © 2024. All market data is provided by Barchart Solutions.

Futures: at least 10 minute delayed. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. To see all exchange delays and terms of use, please see disclaimer.

Commodity Markets: Future Detail

Copyright © 2024. All market data is provided by Barchart Solutions.

Futures: at least 10 minute delayed. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. To see all exchange delays and terms of use, please see disclaimer.

Sign up to receive your Ag Update electronically!

You are now connected to the Hertz network. Unauthorized access is prohibited.

Thank you!

Thanks for applying! We'll follow up with you after we have reviewed your application.

Grain Marketing

Skills

The skills involved in marketing today encompass more than a general outlook of the agricultural economy. Successful producers analyze their ability to carry risk and develop a disciplined strategy to market their commodities.

Marketing Committee

Hertz Farm Management utilizes a marketing committee to formulate a marketing plan tailored towards the individual goals and objectives of the owner. The committee's purpose is to remove emotion from our decision making process as well as customize our objectives to a more personalized approach for each farm. The objectives are reviewed by conference call every two weeks and updated as market conditions change. The committee also makes production estimates as to the size of the domestic and world crops which ultimately effect the price received.

Every Client is Different

We realize every client is different in terms of personality, risk preference, understanding of the futures market, and size of the crop produced. It is important to evaluate risk-carrying ability, the availability of on-the-farm storage, and our anticipation of market direction. We maintain a goal of selling the client's crop in the upper one-third of the market. It is important to note that a crop is usually not all sold at one time, but marketed during different time periods and rallies. A marketing plan is developed for each crop year before planting. Up to one-half of the crop may be forward contracted to take advantage of higher prices offered prior to planting.

Farm Managers

Hertz Farm Management has what we feel are the best trained and most knowledgeable farm managers in the industry. Our managers are comfortable with market alternatives and can customize a marketing plan to fit the goals and objectives of each landowner.

Leases

The purpose of a lease is to define the split of income, expenses, and responsibilities of farm owner and farm operator.

There are several types of leasing arrangements that can be negotiated. The exact terms of the lease will vary depending upon market conditions and individual situations. The return and risk of each type of lease should also be considered.

Another factor to consider is whether you, or your tenant, would like to update the terms of your lease for the upcoming growing season. If so, you will want to send a formal lease termination notice. This does not mean you are terminating the relationship, only that you would like the option to consider updating the terms of your current lease. Each state handles this process a little differently. See below for the termination dates by state.

Lease Termination Deadlines

Iowa – August 31st

Illinois – Oral lease: 4 months prior to end of lease, or generally October 31st

– 4 months prior to end of lease or as specified in the lease

Indiana – Oral lease: 3 months prior to end of lease, or generally November 30th

– Written lease: 3 months prior to end of lease or as specified in the lease

Minnesota – Oral lease: 3 months prior to end of lease, or generally November 30th

– Written lease: 3 months prior to end of lease or as specified in the lease

Missouri – 60 days prior to end of lease

Nebraska – Oral lease: August 31st

– Written lease: August 31st or as specified in the lease

Wisconsin – September 30th

50-50 Crop Share Lease

Historically, it was assumed that the land resource, provided by the landowner, was equal to the operator's contribution of labor and machinery. Over the years, this was the most common type of lease. The crop income and crop expenses are divided equally between the land owner and farm operator. With higher crop yields and less tillage, the trend has been away from 50-50 crop share leases.

50-50 Crop and Livestock Lease

In addition to sharing the crop income and expenses noted above, the landowner participates in the livestock production with the farm operator. The specific lease terms depend on the type of livestock and the livestock facilities.

Modified Crop Share Lease

In addition to the land, the landowner provides all of the seed, chemicals, and fertilizer. The operator provides the machinery, fuel, and labor. Each party is responsible for drying and storing his respective share of the crop. The owner receives from 65 to 80 percent of the crop depending on the quality of the land. This arrangement will normally provide a higher return to the landowner as compared to the 50/50 crop-share lease.

Custom Operation

- The owner receives the entire crop and government payments.

- The owner pays for all the cropping expenses.

- A farmer in the local community is paid to till, plant, and harvest the crops.

Most progressive and timely operators have more than an adequate line of equipment to farm their current operation and are interested in custom farming to have a guaranteed cash flow. As they already have their equipment and labor, their only cost is fuel and repairs. The custom operation will generate a higher net income on above-average land, particularly with favorable yields and commodity prices.

Percentage Lease

A percentage lease is similar to a cash rent lease. However, the owner receives a specified percentage of corn or soybeans delivered to an agreed grain terminal or location and a percentage of the government payment. The operator pays all expenses. This gives the owner some inflation protection and the ability to increase his return through effective grain marketing. Once again, it is important to evaluate the credit worthiness of the proposed operator and to evaluate the herbicide, fertilizer, and method of farming to protect your land investment. Improper application rates and farming methods can reduce the production potential of the farm. Generally, the owner's percentage varies from 30% to 40% depending on the quality of the land.

Cash Rent

An operator pays a set amount of cash and the landowner does not participate in the crop production. Many leases function with one-half of the rent paid on March 1 and the balance paid after the harvest is completed, while some leases are paid entirely on March 1. Current interest rates may influence the payment date arrangement. It is important to evaluate the credit worthiness of the proposed operator and to evaluate the herbicides, fertilizer, and method of farming to protect your land investment. Improper application rates and farming methods can reduce the production potential of the farm. It is equally important to execute a UCC-1 financing statement to ensure collection of the rent.

Variable Cash Rent

Works the same as cash rent with an added variable component. This allows the landowner to share in some of the risk, and reward, without actively participating. The landowner can be guaranteed a base rent, plus a potential variable, or flex, payment. The variable component can be based on several factors that the landowner and operator agree on. Examples include: crop yield, commodity prices, gross income (yield and price) and net income (yield and price minus inputs), among others.

Please contact us to discuss leasing alternatives and an estimate of net income for your farm.

Ag Update Newsletters

Timely Information for Landowners and Investors

Our Winter 2025 Ag Update Newsletter is Here!

In this Newsletter:

- Stewardship in Action: A New Landowner's Journey

- Hertz Professionals Update

- A Disciplined Approach to Grain Marketing

- Farmland Value Update

- Meet Our Stewardship Committee

- Grainfield Partners II, LLP

- Winter 2026 Landowner Educational Seminars - Register Now!

Careers

We are a team of Farmland Professionals dedicated to providing our clients with the highest level of integrity, service and commitment to excellence.

Our Farmland Professionals will be hosting several upcoming Landowner Educational Seminars in February.

Topics include:

- Grain Markets

- Transition/Tax Planning

- Lease Trends/Leasing Alternatives

- Client Services

- Land Trends and Values

- Hertz Farmland Professionals Panel

Additional Information

Registration begins at 8:30 a.m., Seminar from 9:00 a.m. to 3:00 p.m.

- Cost: $35 per person or $50 per couple. Walk-in price: $50 per person, $85 per couple.

- There is no charge for current clients.

- Registration confirmation, an agenda, and a location map will be provided to you.

Choose the seminar location that’s most convenient for you and register today!

Agriculture Industry Links

2024 Year In Review

- Ag Web - 10 Charts to Help Understand the January Data Dump from USDA

- Precipitation Ranks by Climate District ISU Mesonet

- Brazilian Real/US Dollar Trading View

- Federal Funds Effective Rate

- ISU Land Value Survey

- USDA Farm Bill Update

Click the images to download PDF files

Land Values Surveys

- Iowa REALTORS Land Institute (RLI) Land Trends

- ILSPFMRA Land Values Reports

- Iowa State University

- University of Nebraska

- University of Minnesota

- University of Missouri

- Purdue University

- South Dakota State University

- Federal Reserve Bank of Chicago

- Federal Reserve Bank of Dallas

- Federal Reserve Bank of Kansas City

- USDA

4R Plus - Nutrient Management and Conservation for Healthier Soils

Today, the business case for healthy soils is stronger than ever. Thanks to a better understanding of soil management, you know that healthier soil helps retain nutrients and moisture – and can generate a corresponding rise in productivity, profitability and resiliency. It also can increase the value of your land for the next generation.

4R Plus involves using precise 4R nutrient management and conservation practices to provide nutrients when the crop needs them and to enhance soil health and improve water quality. The goal is to achieve a more productive crop now and in the future.

General

- AgWeb - Markets, News, & Weather

- Iowa Natural Heritage Foundation

- Iowa State University - Iowa Environment Mesonet

- National Agricultural Library

- Farm Credit Services of America

- U.S. Drought Monitor

- WASDE

Weather

Agronomic

- Iowa State Extension

- University of Illinois Extension

- University of Minnesota Extension

- University of Nebraska - Institute of Agriculture and Natural Resources

Renewable Energy

Commodity Markets

Copyright © 2024. All market data is provided by Barchart Solutions.

Futures: at least 10 minute delayed. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. To see all exchange delays and terms of use, please see disclaimer.

Current Headlines

Agriculture Industry Information

Keeping You Up-To-Date

Our goal has always been to help landowners better understand their investment and to feel comfortable with their land ownership. The links will help you stay current with recent Ag news and commodity prices.

We have also included some helpful Agriculture links as well as some information on Soil Ratings systems.

Also, we'd love to hear from you. If there are additional topics you would like information on, or websites you feel would be helpful to include, please let us know! Send us an email through our Contact Us Form.

Agriculture Industry Links

Land Values Surveys

- Iowa REALTORS Land Institute (RLI) Land Trends

- ILSPFMRA Land Values Reports

- Iowa State University

- University of Nebraska

- University of Minnesota

- University of Missouri

- Purdue University

- Michigan State University

- South Dakota State University

- Federal Reserve Bank of Chicago

- Federal Reserve Bank of Dallas

- Federal Reserve Bank of Kansas City

- Federal Reserve Bank of St. Louis

- USDA

Land Appraisal Services You Can Trust:

Accurate, Reliable, Agricultural Land Appraisals

In agriculture, accurate land valuations are essential for informed decision-making—whether you're managing an estate, transferring land to family, buying or selling property, gifting property, or navigating legal complexities.

Hertz Appraisal Services delivers high-quality agricultural land appraisals backed by decades of experience, regional expertise, and a deep understanding of the rural land market. We offer prompt, professional service and provide reports that are easy to understand and withstand scrutiny.

Get Started

|

Why Land Appraisals Matter for Farmland Owners

Appraisals are more than just a number—they’re a critical part of:

Estate Planning and Settlements: Establishing fair market value and stepped-up basis for inherited farmland.

Gifting and Family Transfers: Determining accurate values for IRS reporting and family trust structuring.

Buying and Selling: Helping buyers and sellers make informed decisions with confidence.

Legal and Financial Needs: Supporting litigation, asset management, and financial reporting with well-supported values.

Our certified farmland appraisers understand the financial and emotional implications that farmland ownership can carry. That’s why every appraisal we provide is delivered with care, clarity, and professional integrity.

Who We Serve

We work with a variety of clients across the Midwest, including:

We proudly serve clients in Iowa, Illinois, southern Minnesota, western Indiana, and southern Wisconsin. |

Types of Property Our Land Appraisers Evaluate

Every farmland property is unique—and so are the requirements for accurately appraising them. Our team has the experience and tools to assess a wide variety of property types, including:

|

|

Our Appraisal Process: What to Expect

Here’s what you can expect when you work with Hertz to appraise your property.

We listen to understand your needs, deadlines, and objectives. Whether you’re in the early stages of estate planning or facing a tight deadline for a land sale, we adapt to your timeline.

A certified appraiser visits the property to gather detailed information, assess physical characteristics, and note any improvements or encumbrances.

Using comparable sales data, land trends, and market conditions from our extensive network of real estate professionals across the Midwest, we develop a well-supported valuation.

We deliver a comprehensive report using the Uniform Agricultural Appraisal Report (UAAR) format.

Our Reports Are:

- Easy to read and understand

- Compliant with USPAP (Uniform Standards of Professional Appraisal Practice)

- Designed to answer common questions and address potential challenges before they arise

Want to learn more about our reports and appraisal process? Visit our Appraisal FAQ page .

How Our Farm Appraisers Determine Value