Farmland Shows Strength Going Into 2021…

__primary.png?v=1610983371)

Normal life hit the “pause” button on March 13, 2020. In the following weeks, Americans saw sports, schools, offices, live entertainment, manufacturing, retail business, travel and higher trending markets, all seem to come to a grinding halt. From mid-March into mid-June things froze up. “There were so many unknowns about the pandemic, and when that happens, people tend to make no decision rather than chance a bad decision,” says Doug Hensley, President of Hertz Real Estate Services.

Yet, while the general economy stalled, the farmland market barely noticed -- that’s because spring is normally the slowest time of the year for farmland sales. In April and May, farmers concentrate on putting a crop in the ground, not necessarily on attending farmland auctions. “And by late June 2020, when people started to come out of hibernation in the general economy,” Hensley reports, “the land market started to fully function again.” By the end of July, we observed that, in general, there had not been a major disruption to farmland sales. Then, by late summer, market factors began stacking in favor of stronger farmland values.

“The biggest supporting factor underlying farmland values in 2020 has been low-interest rates,” says Hensley. “Twenty-four months ago, we thought rates were low. At that time, the 10-year Treasury note was just over 3%, and when you factor in a pricing margin of 300 to 350 basis points, Farm Credit Services and/or many Midwestern banks were charging long-term mortgage rates around 6%. Now, for most of 2020, the 10-year Treasury rate has been under 1%. Because of that, long-term mortgage rates are at all-time lows, sometimes as low as 3.5% or 4%. Never have interest rates been this low, and that’s causing additional competition in the farmland market. Buyers are finding it a little easier to raise their hand to bid at a land auction, given the big difference between an interest rate of 6% vs. 3.5%. The ability to finance a farm purchase is just much more affordable,” Hensley notes.

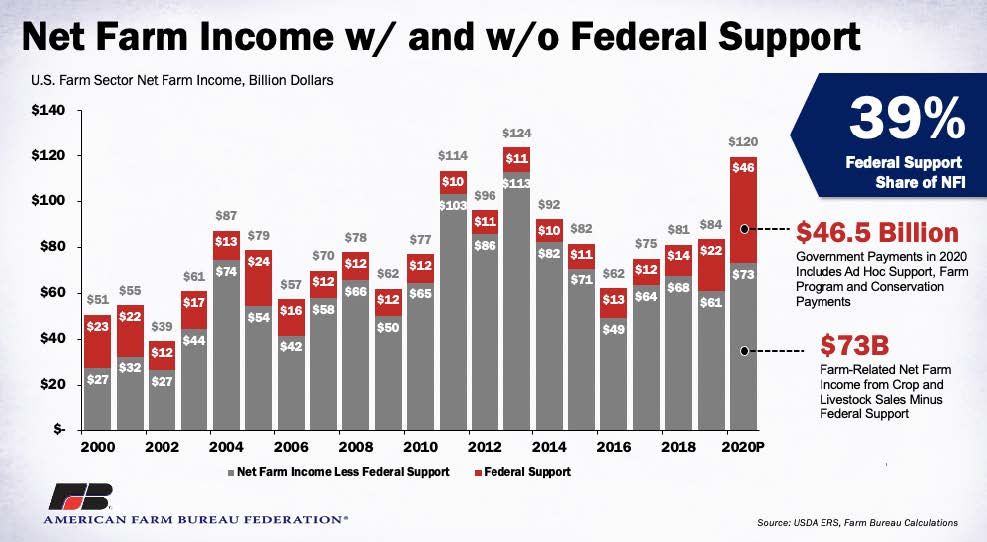

Another supporting factor in current farmland values has been 2020 net farm income, projected to be the second-highest year on record at $120 billion, behind only 2013. Granted, 39% of that is coming from government payments. But that cash will pay a lot of bills and leave some money for investment. Iowa State agricultural economist Wendong Zhang, who has researched how government farm payments get capitalized into land values, expects the $46 billion injected into the farm economy in 2020 government payments will be capitalized into land prices this year and next.

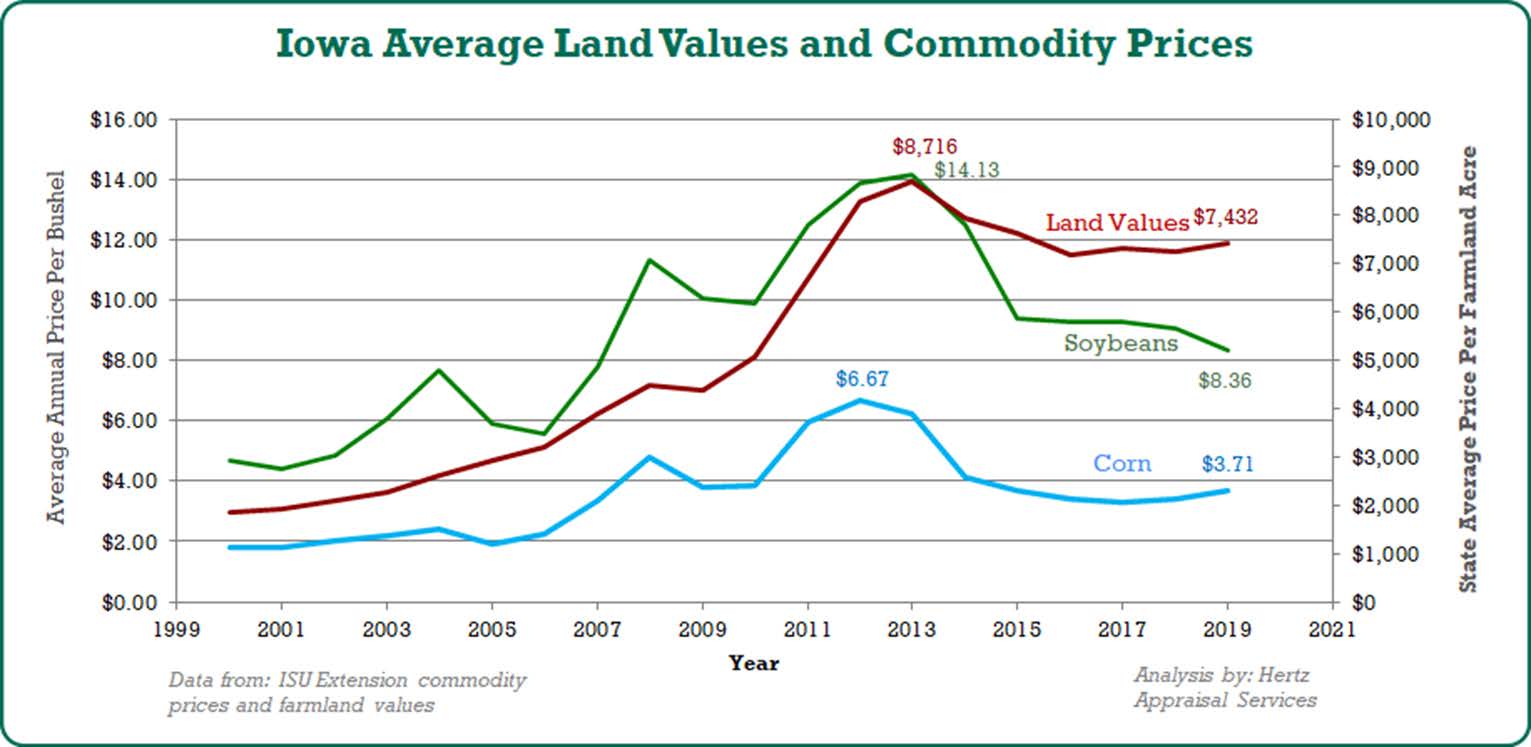

A third factor for a stronger land market in the second half of 2020 was a sharp rise in commodity prices beginning in August. When corn gains $1.00 to $1.50 per bushel and soybeans jump $2.00 to $2.50 per bushel, you’re going to see that reflected in the land market, explains Hensley. Exports to China and a struggling South American crop have shrunk projected grain and oilseed ending stocks and supported higher commodity prices.

“Yet, I don’t think the fall and early winter farmland surveys fully reflect the higher commodity prices, as they hadn’t hit their highs yet at the time the land surveys were conducted,” Hensley notes. The latest Iowa State University land survey showed Iowa farmland on November 1, up 1.7% on average compared to a year ago. The REALTORS® Land Institute farmland survey reported Iowa farmland had increased 0.1% by September 1 compared to a year earlier.

“In fact, we’ve seen more $12,000-$15,000-peracre sales in the past 90 days than in the previous three years combined,” reports Hensley. In November, a Delaware County, Iowa tract (NE Iowa) sold for $17,100 per acre. “That’s higher than we expected,” Hensley notes.

“And seeing the broad strength across the land market since September encourages us as we look into 2021. We’ll continue to watch commodity prices, interest rates, and farmland sales volume -- which look to be supportive for farmland values in 2021,” says Hensley.

Government policy could be the unknown which could pressure land values. “What will happen to farm policy under the new administration? Will ad hoc support payments, such as the Market Facilitation Program (MFP) and Coronavirus Food Assistance Program (CFAP) payments continue? Will crop insurance be altered? And will tax policy change? An increase in income tax or capital gains tax rates; the elimination of 1031-exchanges; or doing away with a step-up in basis on assets at death could negatively affect land values. All of these have been discussed as possibilities under the new administration. But only time will tell.

“If there is anything the pandemic has taught us, it is that 1) people are resilient and 2) people can adapt, and this is especially true in the farm community,” Hensley recognizes. “If any industry is set up for dealing with the unknown, it’s agriculture. Every year, we deal with both weather and price fluctuations, often with wide variations. And every major disruption gives the ag community the opportunity to learn something,” says Hensley.

“Often, the limitations we face drive our innovation,” Hensley adds. “That happens on the farm and that happens at Hertz. Since the pandemic hit, we’ve innovated and adapted, and we now offer more and different ways to buy and sell farms.” In 2020, Hertz had six fully virtual live - online only auctions. “We’ve had a lot of positive comments and feedback from both younger and older buyers alike,” says Hensley.

One farmer who was involved early in testing Hertz’s virtual auction service told Hensley that he was surprised how much he liked the online auction. “Initially, he didn’t think he would like it, but once the auctioneer got started and the bidding got going back and forth, he said he was surprised at how the virtual experience drew him into the sale process. In many ways, the unique virtual experience we’ve worked to create at Hertz has resulted in an even more personal feel for individual buyers. This is not eBay for farms. We’re providing a highly professional virtual experience, where bidders are communicated with and led through the sale.”

Hensley also noticed that farm buyers enjoy the anonymity of an online auction. “The virtual platform allows bidders to compete against a friend or neighbor without the social pressure of being together in the same room bidding at a traditional auction. Bidders are known only by their bidding number so there are no potential hard feelings. Everyone is anonymous except, eventually, the winning bidder.”

Online bidding is also less intimidating than some people feared. In a recent Illinois auction of a relatively nice farm for the area, Hertz had more than 30 bidders logged in. “Even those who don’t use computers much say they surprised themselves as they took an active part in the online bidding process”, says Hensley.

“We’ve also temporarily adapted to online webinars to communicate with our clients and partners,” Hensley adds. “And it seems to have worked well. People have become flexible and Hertz will continue to adapt as changing needs and circumstances arise. While I don’t believe these adaptations will become permanent or totally replace the traditional in-person events, the interest in them is quickly growing.”