Midwestern Farmland: Strong, Market, Weakening Fundamentals

__primary.png?v=1686752967)

Summer 2023

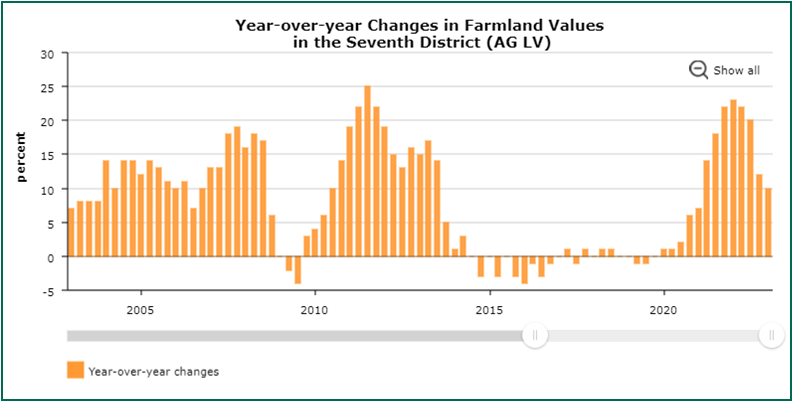

The farmland market has been riding the sails of a bull market for over two years. Recently, however, the winds have started to shift. In particular, weakening commodity prices and higher interest rates are taking some wind out of the sails in farmland values.

“We came into 2023 with farmers having experienced the most profitable year of all time, with good crops and good commodity prices across the Midwest,” explains Doug Hensley, president of Hertz Real Estate Services. “But in January, the grain market started to adjust.” Brazil produced a record soybean crop and a record corn crop in 2023, on its way to topping the U.S. as the number one corn and soybean exporter in the world.

Also, the Federal Reserve has continued its strategy to raise interest rates, in its attempt to tamp down general economic inflation. While the most aggressive moves in interest rates were made in 2022, the most significant impact thus far has landed in residential and commercial real estate, reports Hensley. “Regarding the higher rates, the farmland market hasn’t really reacted in a significant way in the first quarter of 2023,” Hensley says. “The effects of higher interest rates were muted in the farmland sector because many buyers were spending 2022 profits. They had cash and they felt confident using it, given their financial situation. Farmland buyers have just not been borrowing a lot of money.”

Source: Federal Reserve Bank of Chicago

“But then we got to April, and people started to focus forward on the 2023 crop, instead of what happened last year. The planting season was good overall, even if not the smoothest ever,” Hensley explains. But when farmers started to factor in current higher input costs and higher land rents, with commodity markets that had settled back, the mood changed. Farmers were more positive earlier in the spring season because 2023-crop corn futures were hovering closer to $6 per bushel. But by late this spring, new crop corn prices dropped as much as a dollar per bushel, close to $5 per bushel. Likewise the soybean market has given up $2 to $3 in the last 90-120 days. USDA is forecasting the average price received by soybean farmers to be $12.10 per bushel in 2023-24, down from $14.20 per bushel in 2022-23.

“We may have already seen the low in the market this spring, but it’s worth knowing that the export markets for U.S. grain and oilseeds have been horrible in 2023,” notes Hensley. The U.S. corn market has three main uses: generally, roughly 40% goes to livestock feed, approximately 40% is converted into ethanol and the balance 20% is exported. “With Brazil now awash in soybeans and corn, and with importing countries not friendly to the U.S., specifically China, but other countries too, looking for alternative sources, a demand hit in our export business combined with a potential large crop in the U.S. adding to the big Brazilian crops, it’s hurt commodities. And, eventually it could pressure farmland values,” says Hensley. “Some producers have certainly sold ahead and hedged to lock in some profitable grain sales before this commodity weakness, but even then, in a different commodity environment, it may be hard for buyers to see farmland worth $15,000 per acre.”

Lower commodity prices could also lead potential farmland buyers to start borrowing money. “Interest rates are nearly double those of a year ago,” Hensley says. “And from a cashflow perspective, interest rate levels play into forward thinking, reducing how much a buyer wants to pay for land.”

For the better part of a decade, we’ve had low interest rates. “And many people were lulled into thinking that will continue indefinitely. But now, they’ve been snapped to attention,” explains Hensley. The interest rate environment needs to be factored into the land buying equation, and the last time interest rates were this high was 2007.

Higher interest rates are also slowing down the 1031 tax-deferred land exchanges. “We’re still seeing some property developments come on-line. But many, if not most of those, were already in the works,” says Hensley. “The developer appetite seems to be slowing down because housing sales have slowed and there is not as strong a demand for new houses with interest rates at these levels,” explains Hensley.

Inflation is another component of land investing. “Generally, farmland as an asset class has performed well in an inflationary environment,” notes Hensley. But the most direct impact currently is the Fed’s current policy stance of increasing interest rates to combat inflation, which is not supportive to land values. Also, some alternative investments such as money market funds and bank certificates of deposit are now out-performing the 2.5% to 3% annual cash return on farmland investments. So, some potential investors are sitting on the sidelines for now. This could have a small influence on the market, although Hensley does not think it will have an outsize impact, “Because farmers are still the predominant buyer in the land market – 70 to 80% typically – they remain the underlying driver of the land market’s direction.

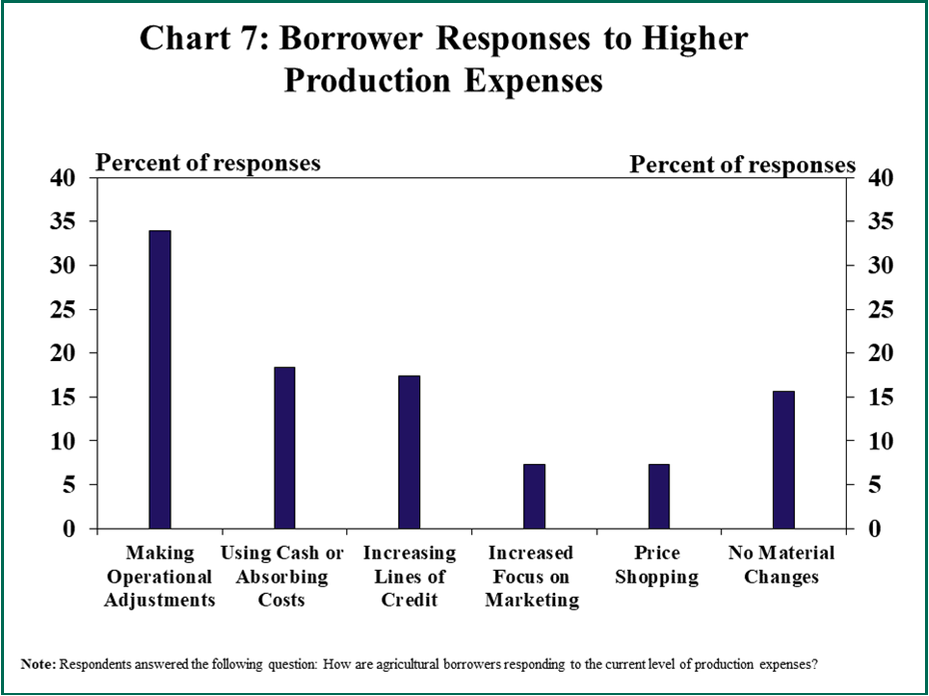

Chart Source: Federal Reserve Bank of Kansas City

“I do want to emphasize the financial condition of the ag sector is very healthy,” says Hensley. “But it’s also clear that we are transitioning into a different market than a year-ago. What we are seeing right now is seemingly a plateau in farmland values. And, there’s more uncertainty in the market than we’ve seen since 2020. We’re still getting calls from interested farmland buyers, but the land market “feels” a little different and just a touch slower,” adds Hensley.

“Out west in the Plains states after years of drought and a devastating winter wheat crop this year, there is some financial weakness. But the belt buckle of the Corn Belt is super financially healthy,” Hensley says. “So, we’re in a wait-and-see market as we transition from summer into fall.”