China Trade Risks Different in 2025 than 2018

__primary.png?v=1750190732)

While China continues to be a major export customer for U.S. soybeans, U.S. agricultural export growth has become less dependent on China. “While China is still a huge world player, we are currently less reliant on China for our major agricultural exports than the last time we tangled back in 2018,” explains Doug Hensley, President of Hertz Real Estate Services.

Tariff negotiations between our two countries do affect commodity markets, but maybe not as strongly as many people fear.

Overall agricultural exports from the U.S. to China fell 14% from January to November 2024, compared to a year earlier, down for a second straight year. “China has not been as significant of an export customer for the past 2 to 3 years,” explains Hensley. Mexico is our number one purchaser of U.S. corn and Canada is our biggest foreign buyer of ethanol.

However, despite the diminished exports, China still buys about half of our soybean exports. Last year that was worth $12.4 billion, according to the U.S. Department of Agriculture. Our next three large soybean customers combined, Mexico, Indonesia and the European Union, purchased about $6 billion of our soybeans in 2024.

But China’s number one soybean vendor is now Brazil. And China relies on agricultural imports from South America, especially in the first half of the calendar year after the major crops in the southern hemisphere are harvested from March to May. So, timing may also be playing a role in the somewhat muted commodity market response to this spring’s tariff kerfuffle.

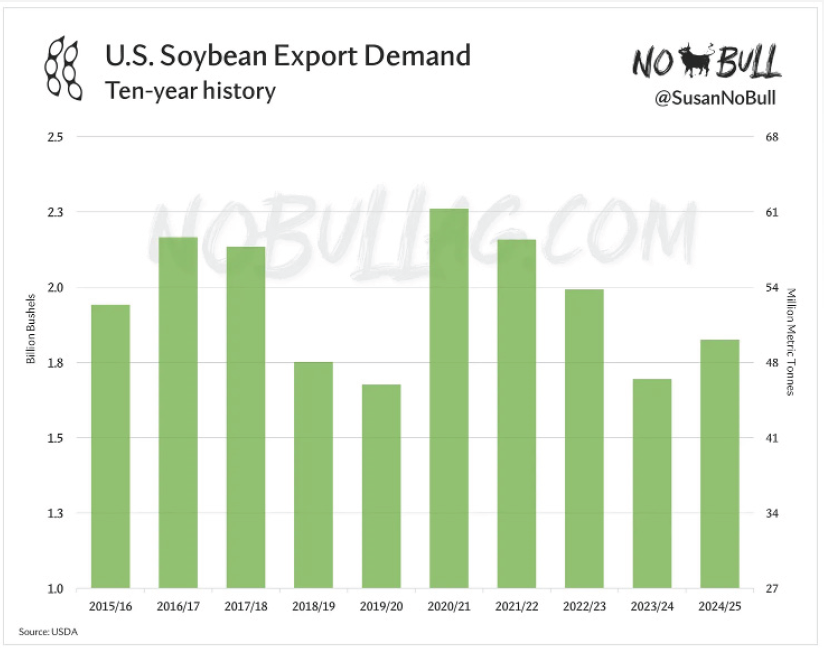

U.S. farmers are paying attention, however, and have cut back on soybean acres, noting that U.S. soybean exports will likely be lower in 2025. In fact, USDA’s estimated soybean acres this year is the lowest since 2020.

So, while tariff negotiations between China and the U.S. are important for U.S. agriculture, they appear to be less vital than back in 2018. It remains to be seen what China will do when it normally buys the bulk of its U.S. soybean needs during our harvest season in the fall.