Farmland Values Update - Summer 2025

__primary.png?v=1748623724)

Here in Q2 of the 2025 calendar year, we can look back on 2024 as a transition year for the Midwestern farmland market. The incredible climb higher in the land market – which began in 2020 and more or less ran through the end of 2023 – turned sideways to lower in 2024. Some regions observed only minor softness, while other areas endured more significant weakness. Timing-wise, the most visible weakness across the marketplace occurred around harvest last fall, when yield uncertainty was heightened, and grain prices were lowest. Since that time, commodity prices have risen and fewer farms have been brought to market, each of which has supported price levels for those farm sales that are occurring. Across the Midwest, here are some additional state specific comments.

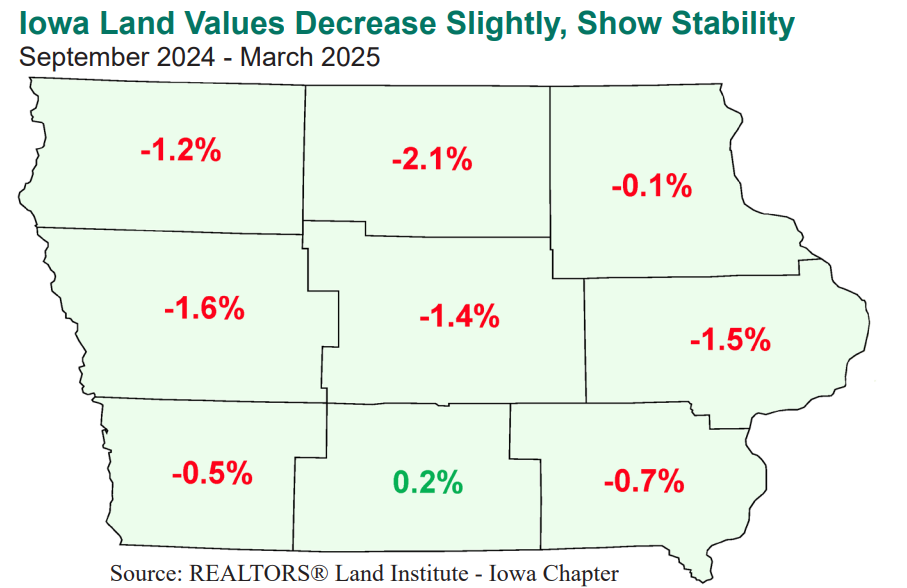

Iowa Land Stabilizing

The REALTORS® Land Institute – Iowa Chapter recently shared the results of their latest land values survey . From September 2024 to March 2025, the average price of farmland in Iowa dipped by just 1%. That’s a smaller drop compared to the prior March to September 2024 report, when values fell by 5%. Altogether, this adds up to a 6% decline over the past year for tillable acres across the state. Even so, survey participants described the early ’25 market as “stable,” noting that buyer interest has picked up since the start of the year. Limited land availability, a recent rebound in crop prices, and expanded government support have all helped steady the market after the the declines seen in 2024.

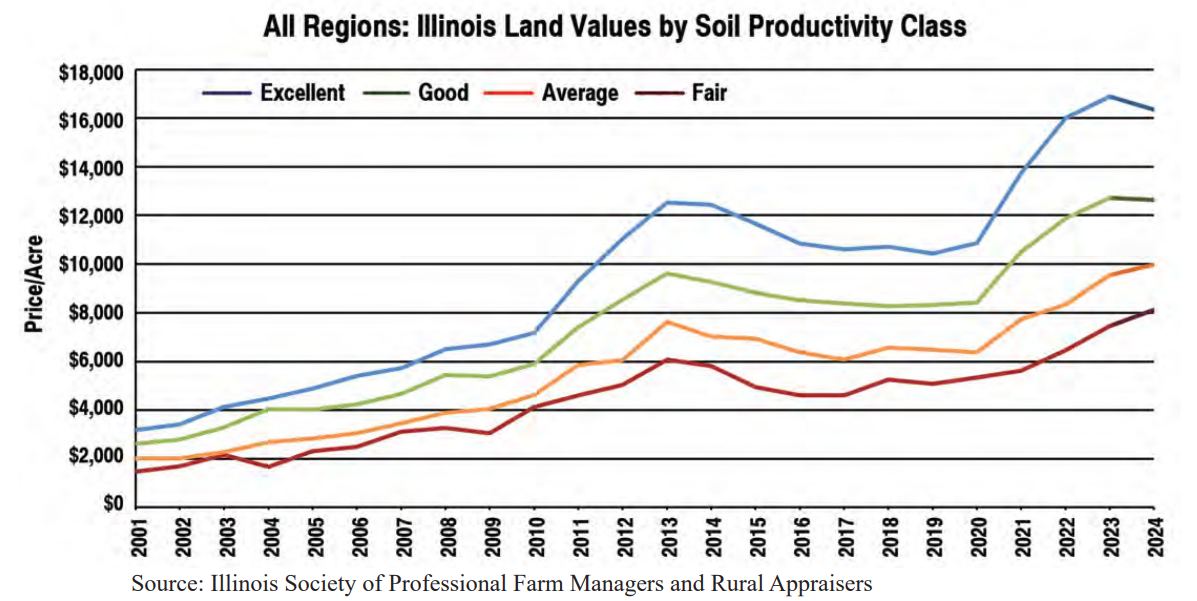

Illinois Land Market Softens

According to the annual survey conducted by the Illinois Society of Professional Farm Managers and Rural Appraisers , “Excellent” quality Illinois land softened by 3-4% in 2024. Further, from the same survey, a majority of survey respondents are expecting farmland prices to either remain the same or decline slightly in 2025. When asked what’s driving their outlook, respondents pointed to a more difficult farm economy, rising interest rates, and weaker commodity prices compared to recent years, as the biggest factors influencing land values.

Nebraska Land Values Dip 2%

According to the 2025 Nebraska Farm Real Estate Market Survey , the average value of agricultural land in Nebraska fell by 2% over the past year. However, the Nebraska survey also tells a divergent story, based on the type of land being considered. Specifically, row-crop farmland was mostly weaker, while pasture and ranchland saw appreciation over the past year. Survey respondents pointed to lower crop prices, higher interest rates, and rising input costs as the key reasons for the minor decline in row-crop land values across the state, while also pointing to higher livestock values and lower feed costs for the support to grazing and ranchland values.

Minnesota Land Values

Changes in land values and rents were mixed across the Minneapolis Federal Reserve District, and across Minnesota specifically. Non-irrigated cropland prices increased ever so slightly in Minnesota, while the district average cash rent for non-irrigated land decreased by almost 2 percent from a year ago. Irrigated land rents fell nearly 4 percent. The Fed Bank reported outlook for agriculture over the opening quarter of 2025 was generally pessimistic, as a large majority of lenders in the Minneapolis district reported an expectation of lower farm incomes in 2025, along with a contractionary outlook for farm capital investment.

Looking Ahead

In conclusion, the Midwestern farmland market turned sideways to lower in 2024, for the first time in 5 years. Now in early 2025, land prices have firmed, based largely on higher commodity markets compared to last fall, limited land sale volumes, and additional government support that was pumped into the countryside beginning in April. As we move into the heart of the 2025 growing season, those factors that firmed the market in Q1 and Q2 should be watched closely for clues on how they may drive land prices in the early fall. As always, we will keep our finger on the pulse, and we will inform you of all that we see.