Farmland Values Resilient Year-over-Year, Stronger in Q1

__primary.png?v=1750191408)

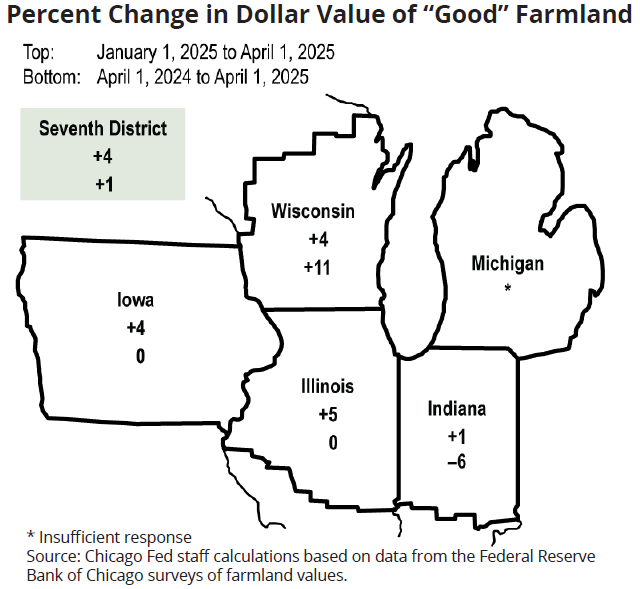

Farmland values across the “I” states found support in the first quarter of this year and remained steady compared to a year ago, according to the Chicago Federal Reserve Bank survey of farm lenders.

However, that was mostly due to a cutback in supply of farmland for sale rather than an overall stronger demand for land. The amount of farmland for sale and the actual sales (by farm number and by acreage) were all lower in the first quarter of 2025 compared to a year earlier.

On the demand side, 29% of the surveyed bankers reported lower demand for farmland in their area, while only 15% of the bankers noted stronger interest in purchasing farmland compared to those wanting to buy in the first quarter of 2024.

Looking ahead, 69% of the surveyed bankers expect farmland prices to be unchanged in the second quarter of 2025.

Annual cash rents declined across the district for the first time since 2020. This year, average annual cast rents slipped 3% in Iowa, declined 2% in Illinois and actually went up 1% in Indiana.

Although not at the “doom and gloom” stage, the farm financial picture is more murky. No banker in the survey observed higher rates of loan repayment in the first quarter, compared to last year, and 39% reported lower rates of repayment by their farm customers. On average, 19% of their farm borrowers (still a small percentage) had more carryover debt from last year’s crop carried over into the new growing season, compared to the amount of carryover debt one year ago.