Farm Economy “Uncomfortable,” But Not “Painful”

__primary.png?v=1768413384)

Farmers cutting back on inputs but support steady rents and land values

This past year, Midwest farmland values maintained themselves in a slightly choppy, sideways trend, reports Doug Hensley, president of Hertz Real Estate Services. And in spite of overtly negative media headlines and similarly negative sentiment in the countryside, farmland values and rents have both largely held their own.

“The farm economy is ‘uncomfortable’ right now because cashflows aren’t good, and row-crop farmers are not making much money – if any. So, producers are putting off new equipment purchases and are trying to cut costs on inputs,” Hensley explains. “But it’s not to the ‘painful’ level, at least not yet, because there is enough equity to carry most farm operations, and farmers are not willing to give up land.” Hensley added, farm lenders will tell you that until you see guys walking away from rented land, along with widespread weaker land rents, and lower land values, the sentiment in the countryside can be unconvincing.

What’s fortifying land values?

“If there is any livestock in the area, you will also see support in land prices,” says Hensley. Cattle production has been incredibly profitable in recent years. Poultry was profitable this year. Hog production cashflows have improved. “Livestock profits are keeping land values very firm, in areas where livestock production is common,” Hensley notes.

Another supportive factor is the diminished volume of land for sale. “Yes, farmland demand is down overall, but the supply of land coming to the market is down just as much or more,” reports Hensley. “There have been a few areas where the land market has been very thin, but even then, there have been enough buyers in the room, that we’ve seen very few no-sale auctions,” says Hensley.

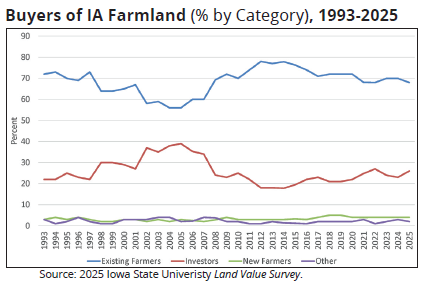

Farmer interest is still high in buying land. Sixty-eight percent of Iowa farmland purchased in 2025 was by existing farmers, according to Iowa State University’s annual farmland survey. Investors accounted for 26% of sales. And although development land is the weakest sector in the land market right now because of the uncertainty in the general economy, there continues to be interest in 1031 tax-deferred, like-kind exchanges, relates Hensley. “That’s in part due to demand from sales of land for computer data centers and server farms to support the growth in artificial intelligence,” Hensley explains. “Twenty years ago, new nonagricultural investor demand was for wind turbines; 4-6 years ago, it was solar panel farms, now it’s hyper-scaler, data center farms.” While not a large part of the farmland market, this investor interest, along with continued farmer buying, has been more than enough to keep land values relatively steady.

Looking ahead

“One thing that is different this winter, is we seem to be seeing a little more turnover/acceleration in row-crop farm operators,” highlights Hensley. This is because row crop farmers are making meager profits right now, and they haven’t really made a significant profit in the past two to three years. “Times like we are currently in, are a part of the agriculture economic cycle, and it’s definitely not a very fun part. I don’t know how long it will last. But as a result, we are seeing more retirement equipment sales, and many retiring farmers are then renting out their land,” Hensley reports. And neighboring operators still want to expand, which is keeping rental rates steady, even as profit margins are very tight.

There is also still strong farmer interest in owning farmland, which is positive for land values. “The land market should generally remain steady unless and until we see farmer buyers stop competing in land purchases,” explains Hensley. “If we were to see an abundance of land come to the market, and farmers were not bidding on those sales, that’s when we’ll have a land market problem,” Hensley advises. “But thus far, buyers still outnumber sellers.”

No one is predicting a financial crisis in Midwestern agriculture at this point. And the structural strength in the asset class is one significant reason why. Eighty-four percent of Iowa farmland is owned with no debt, and neighboring States are likely similar. By far, most of today’s land sales are to settle estates, with inheriting landowners who prefer to take their newfound wealth into other assets. “We may also see a few more ‘financial clean-up’ sales by active farmers who do not own enough debt-free land,” recognizes Hensley. “Their lender may encourage them to recapitalize their balance sheet between now and next spring in order to renew their operating line. But those types of sales are not expected to be widespread.” There has been an increase in farm bankruptcies, but the increase is from a very low number. Between January and October, 2025, Iowa had 18 farm bankruptcies -- about double the number in 2024,” says Hensley.

Government payments help

Last year, the American Relief Act of 2025, legislation passed by the outgoing Biden Administration in December 2024, provided $10 billion in emergency commodity assistance payments that “were timely and covered some debt payments and also paid for some inputs coming into the 2025 growing season,” explains Hensley.

This year, the Trump Administration has announced it will provide $12 billion in similar farm aid payments to farmers. “That will equate to another $30 to $45 per acre for soybeans and corn respectively,” Hensley adds. “If you breakeven on your production costs, or close to it, that government payment for many is in effect a minor profit – which postpones difficult and uncomfortable financial decisions that would otherwise need to be made.”

“Both the Biden and Trump Administrations recognize that the money distributed to farmers also helps support rural banks, input suppliers, machinery dealers, and other rural vendors because those funds flow right back out into the rural economy,” notes Hensley.

With a sideways land market, farm investors will see a 2% to 3% return produced from the income through their farm lease, rather than the average historical 10% to 11% returns, which includes capital appreciation. “Landowners who stay the course will be positioned for the next upside when the cycle turns. No question, we are in the difficult part of the business cycle,” advises Hensley. “There is still optimism out there that things can and will improve – but, it’s uncomfortable. Based on the collective actions of people in the land market, it doesn’t yet seem to be painful. That may seem like splitting hairs, but that’s what stable land values and land rents are telling us.”

Stay Informed on the Farmland Market

Farmland values and market conditions are constantly shifting. Subscribe to receive our monthly market updates and expert insights, so you’re equipped to make confident, well-timed decisions. If you have questions about your land or a recent sale, our farmland experts are ready to help.