Midwest Farmland Surveys Report Minor Price Changes

__primary.png?v=1768419764)

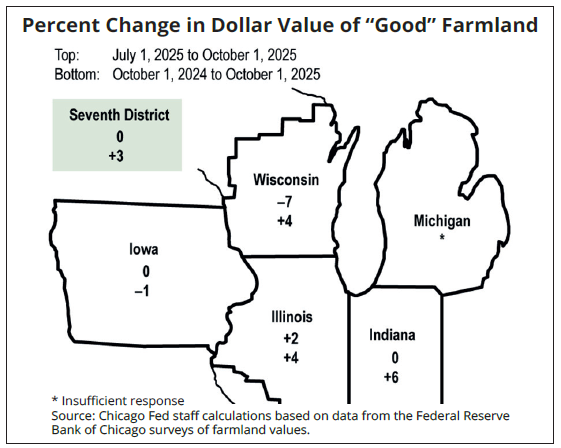

Farmland values surveys across the Midwest describe a mostly sideways trend for farmland values. The third quarter 2025 survey of farmland values by the Chicago Federal Reserve Bank reported an average 3% gain in land values compared to 2024, although there was no change from the second to the third quarter in 2025 for the overall Fed district. Northern Illinois reported a year-over-year average gain of 4% for “good” farmland while Iowa’s average for “good” farmland fell 1% on the full year comparison. The prior quarter survey had reported a slightly stronger year-over-year market in Iowa compared to Illinois, so some of the minor differences may be attributable to timing.

The Chicago Fed survey of 102 agricultural bankers did indicate a little more interest from outside investors in the past year, although farmers are still the majority of farmland buyers.

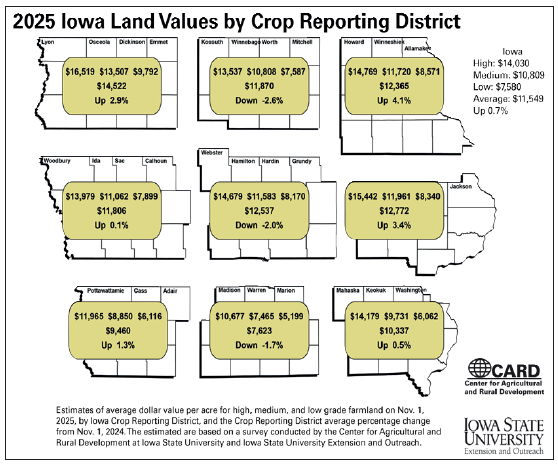

The sideways trend in land values was affirmed by Iowa State University’s annual survey released in December, which reported a slight 0.7% increase in farmland values on average across Iowa.

In Iowa, the strongest gains were in the livestock producing areas in the northwest and northeast counties. Lower grain and oilseed commodity prices, higher input costs and lingering elevated long-term interest rates, kept farmland values across the state in check.

In Nebraska, farmland values declined by 2%, according to the 2025 Nebraska Farm Real Estate Market Survey conducted by the University of Nebraska. However, this followed a record-setting average farmland price reached in 2024 and followed three consecutive years of farmland value increases in Nebraska.

Across the Kansas City Federal Reserve Bank district, which includes Nebraska, Kansas, Oklahoma, western Missouri and mountain states, the average value of irrigated and non-irrigated cropland inched up 1% in 2025 while ranchland land increased 3%, due to strength in the cattle sector. Cash rents in the Kansas City Federal Reserve district on cropland were slightly lower, while ranchland rents increased about 4%.

Finally, a late 2025 farmland value report from the Minneapolis Federal Reserve Bank reported average non-irrigated cropland values increased across the District by 4 percent on average from the third quarter of 2024, while irrigated cropland values were roughly flat, rising by less than 1 percent from the same period last year. Similar to the KC Fed, average cash rents for non-irrigated Minneapolis Fed District land fell by almost 1 percent from a year ago, and irrigated land rents fell by slightly more than 1 percent. Meanwhile, with livestock production more profitable than row-crop farming, ranchland rents increased 5 percent.

Stay Informed on the Farmland Market

Farmland values and market conditions are constantly shifting. Subscribe to receive our monthly market updates and expert insights, so you’re equipped to make confident, well-timed decisions. If you have questions about your land or a recent sale, our farmland experts are ready to help.