Grain Markets - Winter 2022

__primary.png?v=1672257774)

Every crop growing season starts with expectations for total production and grain prices. Price expectations are based on forecasted carryover supplies from the previous year, the outlook for summer weather, and the USDA projections for supply and demand for the current year. Most years, factors change and the outlook can vary greatly throughout the season. Weather and crop development can vary and the USDA’s supply and demand forecast can change. Some years, there can be substantial variation from the USDA’s early season production and demand forecast to the actual results after harvest.

For 2022 the stage was set for expectations with the annual USDA March Planting Intention Report. It was anticipated that the planted acres could shift substantially from the previous year. The USDA in March estimated U.S. producers would plant 89.5 million acres of corn, a decrease of 3.9 million acres or 4.2% from the 2021 corn acres of 93.4 million acres. The forecasted corn acres would have been the lowest since the 2018 acreage of 89.9 million. For soybeans, their estimate was a record 91.0 million acres, which exceeded the previous record U.S. soybean acreage of 90.2 million acres in 2017. The projected soybean acres were up approximately 4.4% from 87.2 million acres in 2021.

The March 31st USDA report was based on producer surveys of planting intentions, as of March 1st. However, there is always the potential for planting intentions to change when final planting takes place. Factors causing changes in the actual U.S. corn and soybean planted acres include the relationship between corn and soybean prices and potential planting delays in some areas of the Midwest. In 2022, we also had higher fertilizer costs for corn production, which motivated some producers to shift additional acres to soybeans. Immediately after the report, with the forecasted acres, December 2022 corn futures closed up $.27 per bushel and November soybean futures closed down $.49 per bushel.

As the growing season progresses the USDA regularly updates their projections. To start the growing season, total production estimates are based on trendline yields, and actual planted acres. Estimated yields are adjusted throughout the growing season, based on summer weather and growing conditions.

After the 2022 Planting Intentions Report, the next key USDA report was the June 30th Acreage Report. USDA’s March Prospective Planting Report projected higher soybean acres than corn, for only the third time in U.S. history. The June acreage report increased corn acres by 431,000 and reduced soybean acres 2.6 million from the March report. The estimated corn and soybean acres in June were 89.9 and 88.3 million acres, respectively. With the change in planted crop acres, the outlook for total corn and soybean total production potential changed from earlier forecasts.

The change in the USDA’s projections is an example of why grain marketing plans need to be continuously updated as the fundamental numbers change. During a typical crop season, several of our grain marketing objectives for our client’s farms will be reached after a volatile reaction to a monthly USDA report.

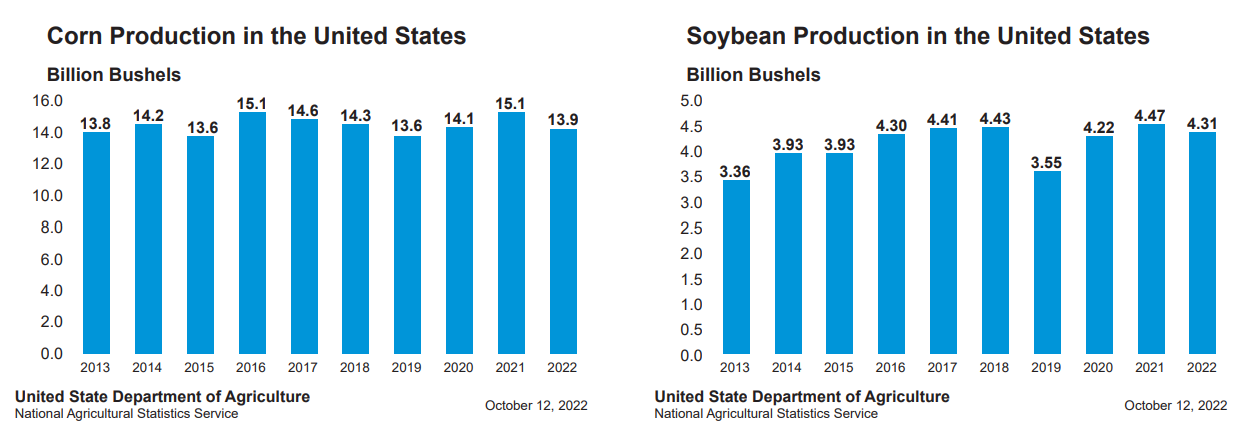

Beyond acreage shifts, the 2022 growing season also demonstrates how the outlook can change from early season projections. As the summer progressed, the USDA continued to lower expectations for the national average corn and soybean yields. When harvest started, the forecast yield for corn was lowered to an average yield of less than 172 bushels per acre for corn, and for soybeans less than 50 bushels per acre. For comparison, the national average corn yield in 2021 was 176.7 bushels per acre, and for soybeans 51.7 bushels per acre. Summer weather and crop growing conditions varied greatly throughout the U.S. With the lower estimated 2022 corn and soybean yields, the forecasted 2022 total corn production is below 14 billion bushels, and the forecasted 2022 soybean production is approximately 4.3 billion bushels. This level of corn production is down approximately 8% from last year and the soybean production total is approximately 3% lower.

Because of the lower than anticipated U.S. corn and soybean production, the outlook for grain prices improved. Carryout for U.S. corn and soybeans stocks are comparable to last year at approximately 1.2 billion and 200 million bushels, respectively. While possible, this does not guarantee we will have a repeat of the high grain prices we had during the summer of 2022.

Grain price direction over the next several months will depend on the USDA’s final production numbers that will be published in January 2023, and long-term demand, which will be influenced by many factors including the U.S. and Global economies, world production, and exports. The conflict in Ukraine also continues to be a major factor influencing grain prices, crop input costs, and crop exports.

The 2022 grain marketing year is a classic example of how quickly the price outlook can change, and the importance of having a marketing plan in place, which is continually updated and modified based on changing market conditions.