Grain Markets - Summer 2022

__primary.png?v=1656018455)

David Krier, Farm Manager, Norfolk, NE

Farmers and landowners across the Midwest sell their crops for market values determined by factors mostly out of their control. Grain marketing continues to be full of uncertainty as international conflicts, global logistics, energy and fertilizer supply, and weather concerns actively affect the markets. We are in a unique year with both historically high grain and fertilizer prices.

News headlines are largely driven by the conflict in Ukraine. As war rages on, we continue to understand the level of influence Eastern Europe has in the agricultural industry. 46% of the world’s sunflowers come from Ukraine. Russia and Ukraine combine to produce slightly more than 1 out of every 4 bushels of wheat in the world. Looking at corn and wheat together, Ukraine is the world’s second largest exporter. Russia is ranked 4th in this category. Countries in Africa, particularly Egypt, as well as the Middle East rely on Ukrainian agriculture. War has forced closures of ports in the Black Sea, limiting the ability to transport crops in and out the region. Ukraine will likely harvest and export less corn and wheat in 2022 which will lead to increased exports for the United States.

Supply chain issues are further escalated as Chinese intermittent Covid lockdowns result in congestion and logjams of materials and goods around the world. U.S exports of corn and soybeans to China are potentially at risk when their ports are not operating at full capacity.

Energy is also a major concern. 40% of Europe’s total demand for oil and natural gas flows from Russia through the Ukraine and Belarus. 60% of Russia’s total oil production goes to Europe. The oil market is on an upward path and has now been disrupted with a major oil producer (Russia) needing to consume additional oil to energize their prolonged war efforts. Agricultural commodities tend to follow the crude oil market.

Changes in logistics, natural gas prices, and demand have sent fertilizer prices soaring to historic levels. From last spring to this year, prices for Anhydrous Ammonia, Potash, and Phosphorus have increased 116%, 103% and 54% respectively. Russia is the world’s largest exporter of fertilizers. Brazil, China, and the United States are their primary buyers. Despite our domestic production, U.S fertilizer prices are still subject to the globally connected fertilizer industry. Distrust and boycotts of Russia and its goods will likely survive the war. Even after the war is over, it will take time to rebuild the necessary infrastructure in the Black Sea region to manufacture and export goods.

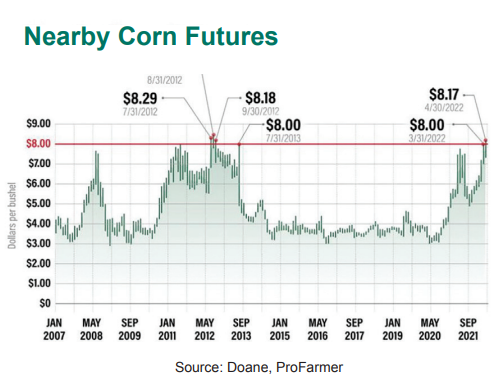

Looking at the corn market, ending stocks have declined since 2016 to 1 billion bushels. We can expect volatility at these levels. Ethanol production has slowed, and livestock numbers are on the decline which reduces demand for corn. Only three times in history have corn prices reached the levels we see today. The December futures market reached a high of $7.57 per bushel on April 29th. In most years, the market peaks during the growing season when yields are most uncertain. This may likely be true again in 2022. As a point of interest, the all-time high futures price for corn is $8.44 per bushel.

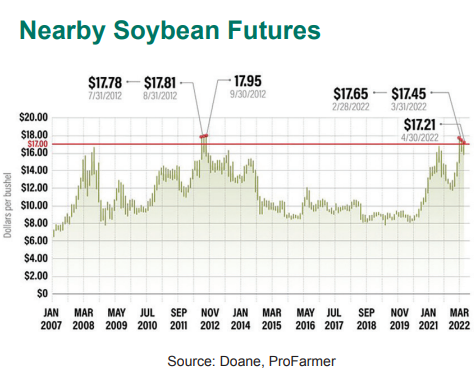

Prices for both corn and soybeans have reached the highest levels since 2012. In the past we have seen historical high prices hurt demand while world competition plants additional corn, soybean, and wheat acres. With historically high input costs led by fertilizer, profit margins will be squeezed tight for those who have not locked in the higher grain prices. The prospect of good crops, a war’s end, and a decline in U.S crop exports to China all contribute to uncertainty in the market.