Grain Markets - Winter 2023

__primary.png?v=1699460729)

As I reflect on my career, which began in 1979, it has become very apparent that commodity markets are constantly evolving, reflecting growth, income, and population, as well as changes in weather, technology, and government intervention.

The 1970s brought unprecedented prosperity to American farmers as soaring prices, increased exports, and production generated record income.

As we moved into the 1980s, commodity demand slowed sharply for approximately two decades. In addition to two major droughts, we faced the farm crisis. High interest rates, excessive supply, and significant declines in income had a tremendous effect on agriculture. To mitigate these negative impacts, the government enacted policies that significantly reduced planted acres and developed a grain reserve that further removed burdensome supplies from the market. In 1985, the Conservation Reserve Program was developed to further reduce planted acres of primarily corn and soybeans. This program continues today, although overall acreage has declined.

The post-2000 demand surge was driven by strong growth, emerging markets, and developing economies most notably China. China’s exceptionally rapid economic growth focused on commodity-intensive manufacturing and investment pushed its economy to grow at near double-digit annual percentages. China’s growing economy increased overall personal wealth, which in turn created robust growth in crop exports- especially soybeans and more recently, corn. A key narrative over the past 20 years has been emphasizing the need to feed a rapidly growing population. This rapid growth not only changed diets in China, but throughout much of the developing world.

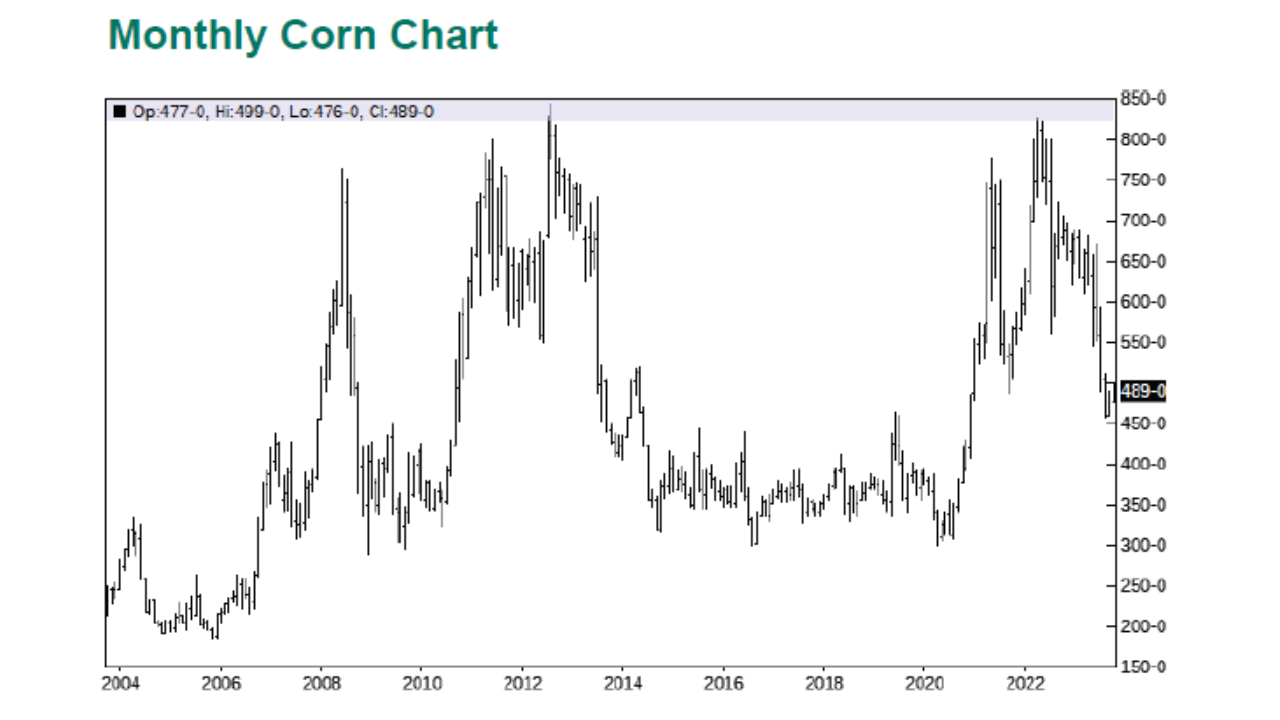

One of the most significant fundamental shifts in agriculture occurred in the early 2000s with the passing of the Renewable Fuel Standard (RFS) and the ascension of China to the World Trade Organization (WTO). These events changed the nature of supply and demand across all commodity markets. The production and use of biofuels in the U.S. grew very rapidly, starting around 2005. Two primary factors contributed to this change; 1) the large increase in crude oil prices through 2008, and 2) implementation of the RFS – first in 2005 and then amended in 2007. The increase in crude oil prices was crucial as it made biofuels more competitive in the marketplace and led to a political reaction in passage of the RFS legislation through Congress. As you can see on the charts included in this article, commodity markets experienced a significant rally based on these events.

Global economic and market conditions will continue to challenge U.S. agriculture. Inflation, extreme weather events, supply chain disruptions, variable input costs, and Russia’s war against Ukraine have pushed commodity prices above historic trends. In addition to these challenges, clean energy technology is advancing at a rapid rate, including cost reductions in generating electricity from renewable sources, battery storage, and electric vehicles. Policies are currently encouraging these changes, which will have an impact on corn demand based on ethanol usage.

Agriculture will survive, as we have detailed in the past four to five decades, but we will continue to see challenges, which will reset the market. Renewable diesel from soybeans and continued development of alternative uses for crops are reasons for optimism in the next 10 years. We are extremely confident that the U.S. agriculture economy will continue to adapt to all these challenges and continue to meet the overall demand of a growing world population.