Grain Markets: Historic Impact of COVID-19

Justin Bahr, Farm Manager, Cedar Falls, IA

The USDA 2020 Prospective Plantings and Quarterly Grain Stocks Report was released on March 31. Corn acres were estimated at 97 million acres, and soybean acres were estimated at 83.5 million for 2020. These estimates result in an increase of approximately 8.1% for corn acres compared to 2019 and an increase of 9.7% for soybean acres. The majority of the increase for both crops comes from millions of prevent plant acres in 2019 returning to production in 2020. These assumed acreage increases raised concerns on the direction of commodity markets prior to the outbreak of COVID-19.

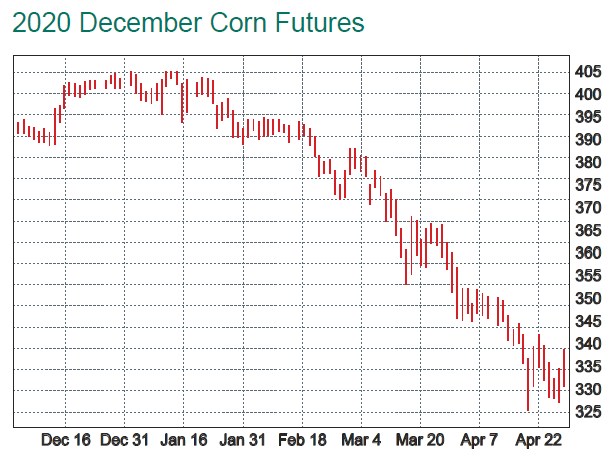

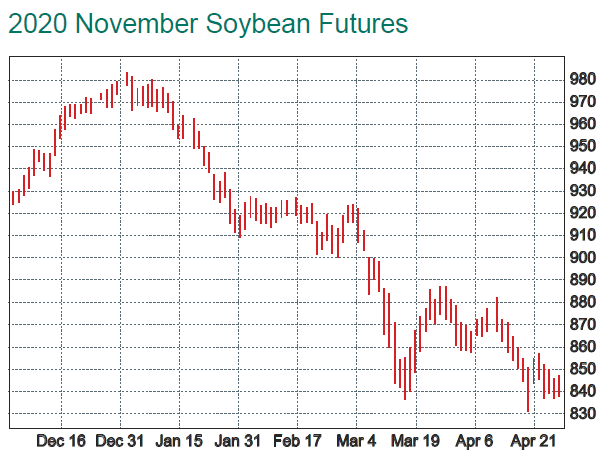

Corn prices traded in a steady range from December 2019 until Early-March. Soybean prices experienced a significant increase in December as optimism for U.S. and China trade negotiators to reach a Phase 1 Trade Agreement improved. The soybean rally faded as COVID-19 fears spread in China. COVID-19’s market disruption put doubt on China’s ability to fulfill their agreement to purchase more U.S. agricultural products. Most traders anticipated a surge in demand following the signing of the Phase 1 trade deal with China. During the same time period, a record South American soybean crop was being harvested and strength in the U.S. dollar made South American soybeans more competitive than U.S. soybeans.

Beginning in March, COVID-19’s impact in the United States resulted in Stay at Home orders which drove gasoline consumption to the lowest level in decades. The limited demand for fuel and an ongoing oil production fight between Russia and Saudi Arabia resulted in high levels of global crude oil supplies. Crude oil prices have fallen to historically low levels, dipping below $20 for the first time since 2002. Corn and soybean prices have dropped to levels that have not been seen in more than a decade as global demand dwindles and supply concerns grow.

Ethanol stocks are at record high levels while production faces the lowest average since the U.S. Energy Information Administration started reporting production in June 2010. Many livestock processing, ethanol, and oil plants have experienced closures or gone idle. The Commodity Credit Corporation (CCC), meanwhile, received a $14 billion replenishment for the 2020 fiscal year. Although a significant amount of government assistance will be directed towards livestock producers, corn and soybean growers will benefit from the effort by maintaining livestock feed demand.

Most areas of the Midwest experienced above average planting pace and near-ideal planting conditions. Favorable weather in April and May makes it hard to find a positive in the corn and soybean markets in the short run.

Commodity, livestock, and equity markets are all trending downward in value as the wait for the U.S. economy to open and recovery occurs. While COVID-19 has certainly impacted commodity markets in a negative way, we still believe there is potential for profitability to improve through the remainder of the crop year. Low interest rates, land stability, trade agreement progress, improved weather conditions, supporting payments from the U.S. Farm Bill ARC and PLC Programs and the possibility of an additional MFP-type payment will all help farm operations. Producers utilizing federal crop insurance will be able to use past production history and current prices to insure their 2020 crop. Managing price risk and maximizing production will be critical for profit margins again in 2020.